MBA Chart of the Week: FHA Seriously Delinquent Loans By Origination Year

Sources: MBA’s National Delinquency Survey; NDS Origination Year (https://store.mortgagebankers.org/ProductDetail.aspx?product_code=DP6-305080-RS-I&_ga=2.210965589.1977019008.1565804914-1902976809.1565804914).

MBA released its second quarter of 2019 National Delinquency Survey results this week (https://www.mba.org/news-research-and-resources/research-and-economics/single-family-research/national-delinquency-survey). While overall delinquencies increased over the previous quarter and from a year ago, loans that were seriously delinquent–90 days or more past due or in the process of foreclosure–dropped. In fact, the seriously delinquent rate reached 1.95 percent, its lowest level since second quarter 2006.

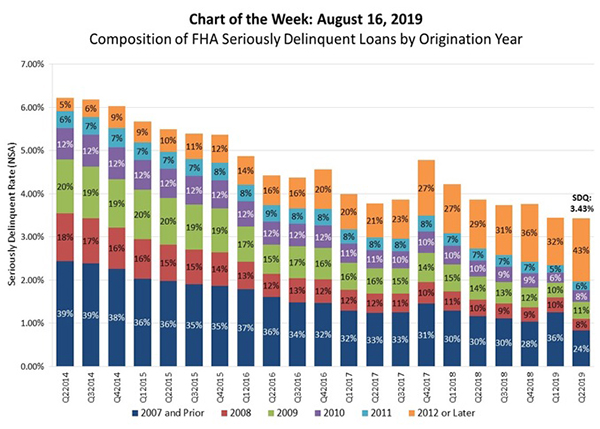

For Federal Housing Administration loans in particular, the serious delinquency rate fell to 3.43 percent in the second quarter, down two basis points from the previous quarter and 43 basis points from a year ago, reaching its lowest level since third quarter 2000.

This week’s chart further examines the trend in the FHA seriously delinquent rate by origination year cohort. While the FHA seriously delinquent rate has decreased to a 19-year low, the cohort of FHA loans contributing to this rate has changed over time. For example, FHA loans originated in 2012 or later represented 5 percent of FHA seriously delinquent loans in second quarter 2014, compared to 43 percent in second quarter of 2019. FHA loans originated in 2007 and earlier represented 39 percent of FHA seriously delinquent loans in second quarter 2014, compared to a still significant 24 percent in second quarter 2019.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Anh Doan is senior financial analyst with MBA. She can be reached at adoan@mortgagebankers.org.)