Dealmaker: Cohen Financial Arranges $50M for Office, Retail, Multifamily

Cohen Financial, Chicago, arranged $50.1 million for properties in Illinois, Georgia and Michigan.

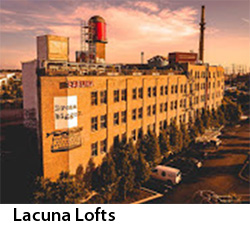

In Chicago’s Pilsen neighborhood, Cohen Financial Managing Director Michael Hart and Vice President Ryan Morris arranged $22 million in acquisition financing with a pension fund for Lacuna Lofts. The 220,000-square-foot asset includes office, retail and event space in a vintage timber loft building that once housed the country’s largest macaroni factory.

In Chicago’s Pilsen neighborhood, Cohen Financial Managing Director Michael Hart and Vice President Ryan Morris arranged $22 million in acquisition financing with a pension fund for Lacuna Lofts. The 220,000-square-foot asset includes office, retail and event space in a vintage timber loft building that once housed the country’s largest macaroni factory.

The borrower, a partnership between Ameritus and JBG Property, will use the bridge loan to enhance the base building, for tenant improvements and to expand the event space.

“Due to its prominent location in Pilsen, Lacuna Lofts offers value to its tenants given the property’s proximity to I-90 and the Chicago loop,” said Hart. “Lacuna Lofts’ event space income benefits from the rooftop deck’s availability.”

The loan closed August 1.

Cohen Financial also sourced a $17.1 million 10-year loan with Goldman Sachs secured by Oglethorpe Square, a newly constructed single-story retail center in Hinesville, Ga., southwest of Savannah. Managing Director Dan Rosenberg and Vice President Matt Terpstra closed the deal.

Dick’s Sporting Goods, Hobby Lobby, TJ Maxx and Ulta Beauty anchor the fully leased center. Rosenberg noted Oglethorpe Square’s tenant stores have long-term leases and the surrounding area benefits from nearby Fort Stewart, the largest Army base east of the Mississippi River.

In Grand Rapids suburb Jenison, Mich., Cohen Financial Managing Director Cathy Bronkema arranged an $11 million short-term bank loan with SunTrust Bank for Cottonwood Forest Apartments. The community has 160 one- and two-bedroom units in two-story townhouse-style buildings. Bronkema said Trillium Investments, Grand Rapids, will use the bridge financing to acquire the asset and to reposition and upgrade the units and plans to secure a long-term agency or FHA loan after the repositioning.