Finding Common Ground on Capitol Hill

WASHINGTON–With the Nation’s Capital at its most polarized in years, it might be surprising to hear about the House Problem Solvers Caucus.

Consisting of 22 House Republicans and 22 House Democrats, the Caucus meets once a week to discuss issues in which they can find common ground. Additionally, members of the Caucus agree not to campaign against each other.

“When you sit down across the table with someone and you listen to what’s important to them, you learn how to find solutions,” said Rep. Josh Gottheimer, D-N.J., a member of the Caucus, speaking here at the MBA National Advocacy Conference.

“When you sit down across the table with someone and you listen to what’s important to them, you learn how to find solutions,” said Rep. Josh Gottheimer, D-N.J., a member of the Caucus, speaking here at the MBA National Advocacy Conference.

“I served in Iraq and Afghanistan, and I’ve seen better relations between Shiite and Sunni Muslims than I have on Capitol Hill,” said Rep. Steve Watkins, R-Kan., “We don’t throw our principles out the door, but we do commit to work together.”

Gottheimer said occasionally it’s problematic. “When it comes to votes, the leadership wants you to vote the way they want you to vote,” he said. “But I think we were elected to come here and get things done and sometimes that means going against the grain.”

For example, Gottheimer was one of just 31 Democrats to vote for S.2155, the Economic Growth, Regulatory Relief and Consumer Protection Act, which passed in 2017. “Josh took that tough vote and helped make it the law,” Watkins said.

Watkins and Gottheimer agreed that the Caucus’s most important victories have come through changes to House rules that made it easier for bills to come to the House floor. “We had more than 30 bills in the 115th Congress that had more than 300 sponsors that never made it to the House floor because extreme factions of the House killed the bill,” Gottheimer said. “We got changes to the House rules to move these bills to the vote and prevent these extreme factions from gumming up the process.”

Watkins noted that there is a similar, smaller group in the Senate with whom the Problem Solvers Caucus meets. “If you like this approach, then get to know your members of Congress and encourage them to participate,” Watkins said.

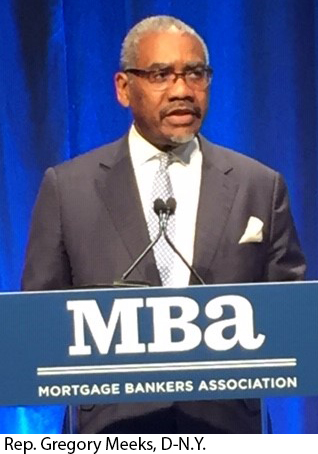

Rep. Gregory Meeks, D-N.Y., Chairman of the House Financial Services subcommittee on Consumer Protection and Financial Institutions, said homeownership is key to achieving the American Dream. In his 11th term, he is a member of the New Democrats, a coalition of more than 100 moderate members of the House; as well as the Congressional Black Caucus. He said expanding credit and creating homeownership opportunities is a priority of his subcommittee.

Rep. Gregory Meeks, D-N.Y., Chairman of the House Financial Services subcommittee on Consumer Protection and Financial Institutions, said homeownership is key to achieving the American Dream. In his 11th term, he is a member of the New Democrats, a coalition of more than 100 moderate members of the House; as well as the Congressional Black Caucus. He said expanding credit and creating homeownership opportunities is a priority of his subcommittee.

“We tell people, ‘rent the car and own the house,'” Meeks said. “A car is a depreciating asset that loses value the minute you drive it off the lot; a house appreciates in value, especially in recent years.”

Meeks said growing up in a segregated community in New York gave him insights in growing wealth and equality. “The wealth gap poses the greatest threat to the economic system; we have to close that gap,” he said. “The strongest argument for housing finance reform is the need to build homeownership among low- and moderate-income families and give them the opportunity to build wealth.”

Meeks said housing finance reform rests on three principles. “The federal government backstop is essential,” he said. “Your organization understands the importance of a liquid secondary mortgage market, which leads to a more liquid primary housing market.”

Second, reform must include modernization of scoring models used by Fannie Mae and Freddie Mac. “There are newer models that use more predictive data, enabling lenders to make better credit decisions,” he said. “Competition in this space can help score borrowers more accurately, particularly those who do not have traditional means of credit.”

Third, Meeks said, reform must include reasonable alternatives to foreclosure programs for borrowers. “As we saw during the recent crisis, the cost of foreclosures is too great; there are too few alternatives. We need more foreclosure alternative programs.”

“The status quo is not acceptable today,” Meeks added.