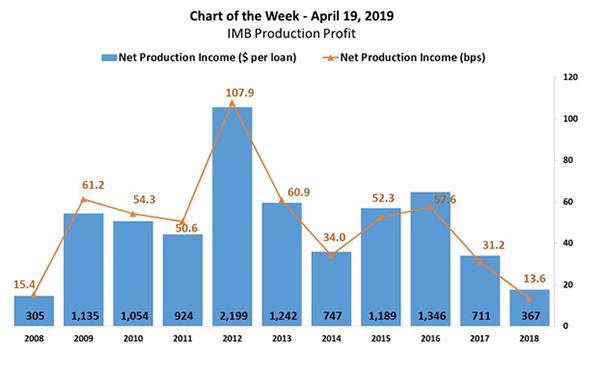

MBA Chart of the Week: IMB Production Profit

Source: MBA Annual Mortgage Bankers Performance Report; www.mba.org/performancereport.

The combination of lower production revenues and higher expenses in 2018 contributed to the lowest net production income per loan since 2008, according to the MBA Annual Mortgage Bankers Performance Report released last week.

Last year, independent mortgage banks and mortgage subsidiaries of chartered banks reported average pre-tax production profits of $367 on each loan they originated (14 basis points), down from $711 per loan (31 basis points) in 2017.

Production revenues per loan dropped despite study-high loan balances in 2018. At the same time, production expenses per loan grew to a study-high of $8,278 per loan in 2018, compared to $8,082 per loan in 2017.

Including all business lines (both production and servicing), 69 percent of the firms in the report posted pre-tax net financial profits in 2018, down from 80 percent in 2017.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Jenny Masoud is associate director of analytics with MBA; she can be reached at jmasoud@mba.org.)