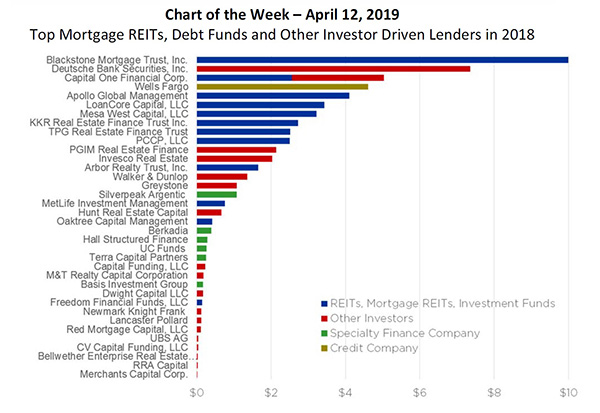

MBA Chart of the Week: Top Investor-Driven Lenders, 2018

Source: MBA 2018 Rankings of Commercial of Commercial/Multifamily Mortgage Firms’ Origination Volumes.

Mortgage real estate investment trusts, debt funds and other “investor-driven lenders” are one of the hottest capital sources in today’s commercial real estate finance markets.

In 2016, intermediaries originated $32 billion of loans for these lenders. Continuing the upward trend, $52 billion in loans were originated in 2017, and $67 billion last year. The funding comes from a variety of companies pursuing a range of strategies.

Since 2005, MBA has produced a set of league tables detailing players in the commercial mortgage origination market, the roles they play and the capital sources and property types in which they operate. Given the growth of investor-driven lenders in recent years, MBA made a special push to include the investor-driven lenders in the 2018 league tables.

Last year, Blackstone Mortgage Trust Inc., with $10 billion of mortgage lending for REITs, mortgage REITs and specialty funds, led the pack, followed by Deutsche Bank Securities Inc., Capital One Financial Corp., Wells Fargo, Apollo Global Management, LoanCore Capital, LLC, Mesa West Capital, LLC, KKR Real Estate Finance Trust Inc., TPG Real Estate Finance Trust and PCCP LLC.

For more details, see MBA’s 2018 report on the top commercial/multifamily mortgage originators in 2018: https://www.mba.org/news-research-and-resources/research-and-economics/commercial/multifamily-research/annual-origination-volume-summation.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)