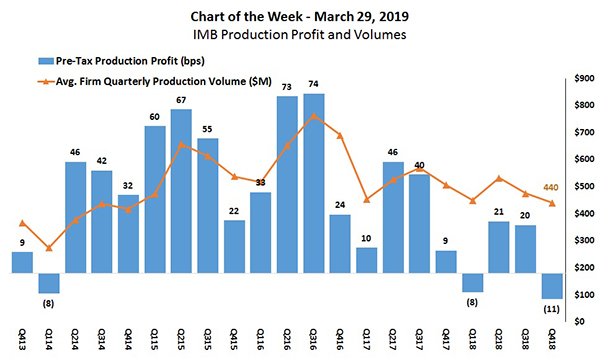

MBA Chart of the Week: IMB Production Profit and Volumes

Source: MBA’s Quarterly Mortgage Bankers Performance Report www.mba.org/performancereport.

Independent mortgage banks and mortgage subsidiaries of chartered banks reported average pre-tax production losses of 11 basis points (a loss of $200 on each loan they originated) in the fourth quarter, down from 20 basis points ($480 per loan) in the third quarter, according to the MBA Quarterly Mortgage Bankers Performance Report released last week.

Contributing factors to this record low profit loss included a continued drop in overall production volume, lower revenues and higher costs relative to the third quarter. Total production revenue decreased to 351 basis points ($8,411 per loan) in the fourth quarter from 358 bps ($8,654 per loan) in the third quarter. Mortgage bankers saw their total loan production expenses increase to 362 bps ($8,611 per loan) in the fourth quarter, from 338 bps ($8,174 per loan) in the third quarter.

Including all business lines (both production and servicing), 44 percent of the firms in the study posted pre-tax net financial profits in the fourth quarter, down from 71 percent in the third quarter.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Jenny Masoud is associate director of analytics with MBA; she can be reached at jmasoud@mba.org.)