Regulators, Industry ‘Must Work Together’ to Protect Consumers

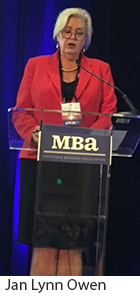

LOS ANGELES–Jan Lynn Owen, Commissioner with the California Department of Business Oversight, observes the state’s $2.7 trillion annual economy makes it the world’s fifth-largest.

It also poses regulatory challenges, Owen said. She noted the sheer size of California’s business infrastructure makes it essential that mortgage lenders and servicers work collaboratively with her department.

It also poses regulatory challenges, Owen said. She noted the sheer size of California’s business infrastructure makes it essential that mortgage lenders and servicers work collaboratively with her department.

“As the State’s regulator, I want to work with the industry to ensure a safe, stable housing market,” Owen said here at the Mortgage Bankers Association’s Risk Management, Quality Assurance and Fraud Prevention Forum.

Owen noted much of her job involves “applying old rules to new industries.”

“I deal with a lot of people who tell me they have a product that features the latest technology and will change the world,” Owen said. “The products are clever and promising; they provide clear benefits for consumers. But they also have potential traps; from a regulatory standpoint, the product is a square peg that doesn’t fit in a round hole.”

“We don’t want to choke innovation,” Owen added. “Our system of government, with its processes and procedures, moves much more slowly than do entrepreneurs wearing skinny jeans. That means for now, the product has to comply with existing law.”

Owen said it will take “serious” effort by the industry to continue to manage quality assurance. “We have to work very hard to ensure that consumers are protected,” she said.