On Anniversary of GSE Conservatorship, MBA, Trade Groups Issue ‘Open Letter’ to Administration, Congress on GSE Reform

The Mortgage Bankers Association and nearly 30 trade groups representing the real estate finance industry and community groups took the extraordinary step of publishing an Open Letter to the Trump Administration and Congress, urging them to step up efforts to reform the secondary housing market.

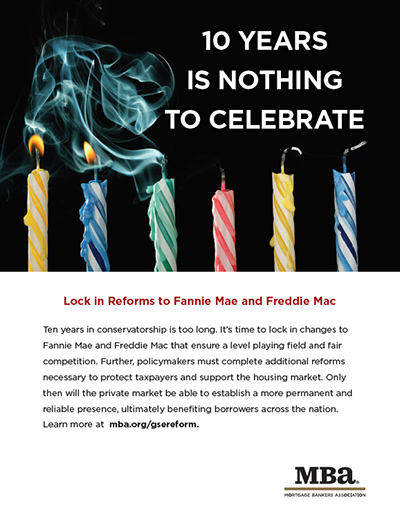

Separately, MBA began running an advocacy print advertisement in major Capitol Hill newspapers urging Congress and the Administration to move forward on GSE reform.

The letter comes on the 10th anniversary of the federal government’s takeover of Fannie Mae and Freddie Mac; the government-sponsored enterprises were placed in conservatorship on Sept. 6, 2008 and have remained under the supervision of the Federal Housing Finance Agency since, despite assurances by officials from three Administrations that a solution was forthcoming.

The letter, A Defining Moment for Housing Finance: The Need to Preserve Access and Affordability, points out that GSE reform has not happened despite “one of the longest economic expansions on record” and in light that the housing market has largely recovered from the housing crisis.

The letter, A Defining Moment for Housing Finance: The Need to Preserve Access and Affordability, points out that GSE reform has not happened despite “one of the longest economic expansions on record” and in light that the housing market has largely recovered from the housing crisis.

“Reforms put in place during the conservatorship have better positioned the GSEs to continue to play a vital role in facilitating mortgage liquidity,” the letter says. “Such reforms include pricing parity across lenders, the transfer of risk off of taxpayer shoulders, a new infrastructure for the single-family secondary market and support for strong and sustained liquidity in the multifamily rental market.”

However, the letter notes the GSEs’ long-term ability to support the housing market, without exposing taxpayers to excessive risk, depends on the outcome of efforts to “permanently reform the structural problems that contributed to the crisis. Only with the certainty that comes from these reforms and the end of the conservatorship will the private market be able to establish a more permanent and reliable presence in housing finance.”

The letter states any effort to change the role played by the GSEs must contain safeguards against higher costs or other market disruptions that reduce access to mortgage credit in both the single-family and multifamily markets and enforceable mechanisms to serve the entire market of renters and qualified home buyers, including underserved markets and manufactured housing.

“To achieve these goals, policymakers must take great care that further actions to reform the GSEs are prudently developed and implemented over a sensible time horizon,” the letter says. “Moreover, reforms should reflect a pragmatic understanding of the market and the mechanisms by which credit is delivered. Housing is simply too important to our national economy and our local communities to risk disruption of the system by which it is financed.”

The letter urged lawmakers to “lock in recent reforms” to the GSEs and complete additional reforms. “Only through such efforts can we ensure an affordable, accessible housing finance system that works for American homeowners and renters alike,” it said.

Meanwhile, the MBA ads began running this morning in publications including The Hill and Roll Call, which target the federal government. The ad, 10 Years is Nothing to Celebrate, touts MBA’s 2017 proposal for GSE reform, found at www.mba.org/gsereform.

“Ten years in conservatorship is too long,” the ad says. “It’s time to lock in changes to Fannie Mae and Freddie Mac that ensure a level playing field and fair competition. Further, policymakers must complete additional reforms necessary to protect taxpayers and support the housing market. Only then will the private market be able to establish a more permanent and reliable presence, ultimately benefiting borrowers across the nation.”