MBA Chart of the Week: Commercial/Multifamily Delinquency Rates Since 1996

Sources: Wells Fargo Securities LLC; and Intex Solutions Inc.; American Council of Life Insurers; Fannie Mae; Freddie Mac; OFHEO; Federal Deposit Insurance Corp.

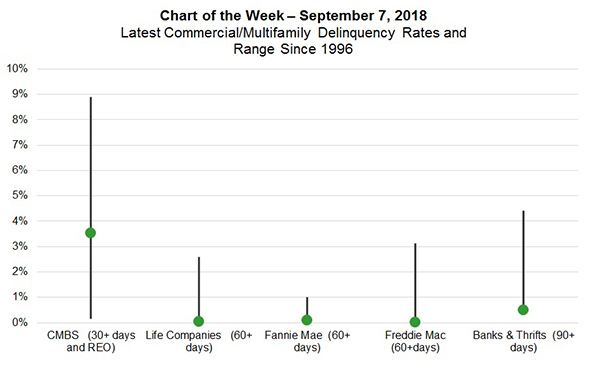

It is hard to overstate how low commercial and multifamily mortgage delinquency rates are today.

Only three-one-hundredths of one percent (0.03 percent) of the balance of commercial and multifamily mortgages held by life insurance companies is delinquent, as is one-one-hundredth of one percent (0.01 percent) of the balance of multifamily mortgages held by Freddie Mac. The delinquency rate for loans held on banks’ balance sheets is the lowest in the series history.

The one outlier is the commercial mortgage-backed securities market, which continues to work through loans that went into foreclosure and REO during the Global Financial Crisis (for more on that, see our Chart of the Week from May 19, 2017: https://www.mba.org/publications/insights/archive/mba-insights-archive/2016/mba-chart-of-the-week-1998-2007-vintage-conduit-cmbs-balance-60d-including-fc/reo-and-delinquency-rate).

Because different capital sources calculate delinquency rates in different ways, the delinquency rates shown are NOT comparable between investor groups. As a result, these rates do show how the performance of loans for each investor groups has varied over time, but cannot be used to compare one investor group to another.

The key takeaway is that strong property fundamentals and values, coupled with low interest rates and ample financing options, all continue to support commercial real estate owners and their abilities to repay their mortgages.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)