MBA Chart of the Week: Commercial/Multifamily Mortgages Intermediated to Non-Traditional Lenders

Source: MBA CREF Database and Mid-year Originator Rankings.

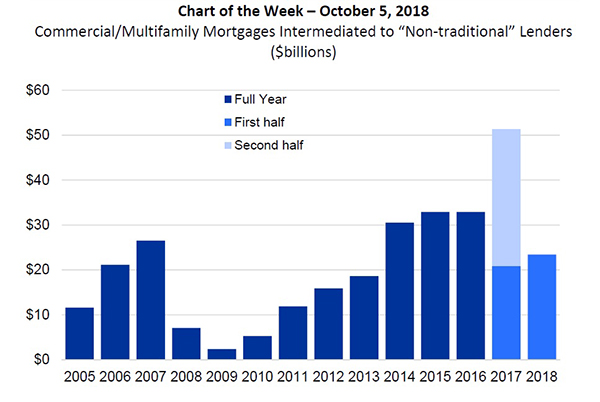

The role of “non-traditional” lenders continues to grow within the commercial real estate finance market.

During the first half of 2018, commercial and multifamily mortgage originations increased by 2 percent from a year earlier. During the same period, loans intermediated for non-traditional lenders–including real estate investment trusts, debt funds, specialty finance companies and others–increased by 12 percent.

For purposes of this discussion, traditional lenders include banks, life insurance companies, Fannie Mae, Freddie Mac, FHA and commercial mortgage-backed securities issuers, which collectively account for 88 percent of all commercial and multifamily mortgage debt outstanding. During the first half of 2018, originations increased by 14 percent for Fannie Mae and Freddie Mac and by 7 percent for life companies. Originations for CMBS and for commercial bank portfolios declined.

Non-traditional lenders have been drawing increased attention and activity (https://www.mba.org/news-research-and-resources/research-and-economics/commercial/multifamily-research/blog/blog-posts/current-blog-posts/alternative-lenders). Commercial mortgage intermediaries, who work with borrowers to originate loans but do not close them in their own name, reported $23.4 billion of loans for REITs, debt funds, specialty finance companies and others during the first half of 2018, an increase of 12 percent from the $20.9 billion reported a year earlier.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)