MBA Chart of the Week: Technology Spending

Source: MBA and Celent Technology Spending Survey 2018, The Loan Origination Process (https://www.mba.org/news-research-and-resources/research-and-economics/single-family-research/technology-profile-surveys).

MBA and Celent (a research, advisory and consulting firm) recently released results of their Technology Spending Survey 2018, The Loan Origination Process. The Survey was completed by Chief Information Officers at mortgage lending institutions.

CIOs were asked to report changes in their technology spending levels for 2018 (budget) versus 2017 (actual) across six different areas of the loan origination process: sales/application; fulfillment; core origination and secondary functions; digital imaging and enterprise content management; closing; and emerging technologies such as robotics and blockchain.

There were a total of 28 different technology categories related to the loan origination process; other spending categories such as infrastructure, data security, network administration and servicing were excluded.

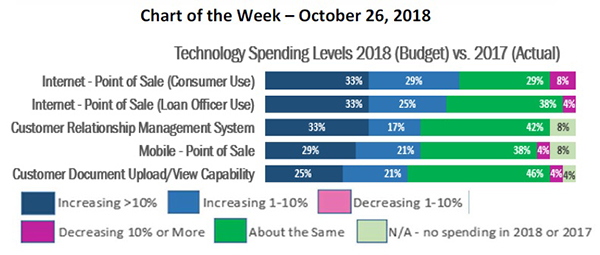

Today’s Chart of the Week features the top five technology categories in the loan origination process identified by CIOs as having the highest annual spending growth. For the most part, these technologies are focused on the very front-end of the loan origination process and are consumer interfacing, allowing consumers to have more control over the loan origination process. Technology spending increases for regulatory compliance, previously one of the greatest concerns to CIOs, ranked #9 out of 28 categories in this survey.

The Survey also polled lender and/or mortgage applicant utilization and adoption rates. A joint MBA and Celent webinar will take place on November 28, so please contact us for details. For more information on this survey, our other tech surveys, or on how to purchase the survey results, please visit: www.mba.org/techsurveys.

(Jenny Masoud is associate director of analytics with MBA; she can be reached at jmasoud@mba.org.)