MBA Economic and Mortgage Finance Commentary: Purchase Originations Expected to Increase Gradually Through 2021

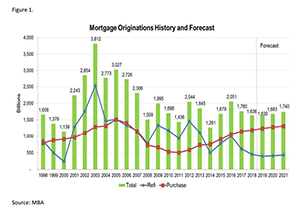

Our forecast, released at the MBA 2018 Annual Convention and Expo in Washington, D.C., estimates $1.24 trillion in purchase mortgage originations in 2019–a 4.2 percent increase from 2018. Refinance originations will continue to trend lower next year, decreasing by 12.4 percent to $395 billion.

Overall in 2019, total mortgage originations are forecasted to decrease to $1.63 trillion from $1.64 trillion this year. In 2020, we are forecasting purchase originations of $1.27 trillion, and refinance originations of $410 billion, for a total of $1.68 trillion (Figure 1).

Overall in 2019, total mortgage originations are forecasted to decrease to $1.63 trillion from $1.64 trillion this year. In 2020, we are forecasting purchase originations of $1.27 trillion, and refinance originations of $410 billion, for a total of $1.68 trillion (Figure 1).

The unemployment rate is at its lowest level in almost 50 years, resulting in faster wage growth and more confident homebuyers. The unemployment rate will decrease to 3.5 percent by the end of 2019, which should continue to keep housing demand at a healthy level, ultimately leading to an increase in purchase originations. With the economy running at full employment, monthly job growth is expected to average 120,000 in 2019, down from the monthly gains of 200,000 seen this year.

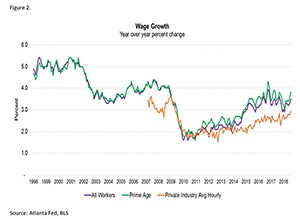

Economic growth is expected to continue its strong showing into 2019 before some deceleration in  2020 and 2021. We forecast 2.3 percent growth in 2019 and 1.5 percent growth in 2020 and 2021. This growth will help support the job market and wage growth, which is an important factor for housing. We see wage growth trending higher (Figure 3), especially given how many openings there are in the economy and how low unemployment is. In addition to the healthy job market, demographics will also help to drive the increase in purchase originations as a large segment of the population is currently at or approaching home buying age.

2020 and 2021. We forecast 2.3 percent growth in 2019 and 1.5 percent growth in 2020 and 2021. This growth will help support the job market and wage growth, which is an important factor for housing. We see wage growth trending higher (Figure 3), especially given how many openings there are in the economy and how low unemployment is. In addition to the healthy job market, demographics will also help to drive the increase in purchase originations as a large segment of the population is currently at or approaching home buying age.

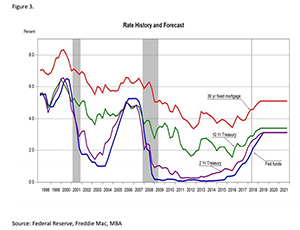

While the Federal Reserve is expected to increase short‐term rates further, 30‐year mortgage rates should rise only modestly from here, averaging 5.1 percent for 2019 through 2021. We expect that  the Fed will raise rates three times in 2019 and hold the fed funds rate at just over 3 percent, as shown in Figure 3.

the Fed will raise rates three times in 2019 and hold the fed funds rate at just over 3 percent, as shown in Figure 3.

While the macroeconomic and housing market backdrops are, and should remain quite favorable, the mortgage industry continues to be challenged by the drop in overall origination volume, coupled with significant margin compression. Lenders of all types and sizes are seeing elevated costs, coupled with intensely competitive pricing, to capture more volume. This in turn is depressing  revenues. We most recently highlighted some of these trends in a Chart of the Week focusing on independent mortgage bank profitability.

revenues. We most recently highlighted some of these trends in a Chart of the Week focusing on independent mortgage bank profitability.

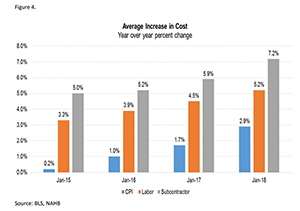

Another challenge has been and will continue to be the supply of houses for sale. Builders face challenges finding the labor to complete projects, both in terms of workers for building directly and subcontractors for specialty jobs such as drywall, plumbing, etc. See Figure 4. Additionally, lumber and other input costs have increased dramatically, land for building has been tough to secure, and financing for smaller builders to fund their projects has been a challenge.

MBA revised its estimate of originations for 2017 to $1.76 trillion from $1.71 trillion, to reflect the most recent data reported in the 2017 Home Mortgage Disclosure Act data release.

(Each month MBA economists provide commentary on the current mortgage finance and economic climates, plus insights into how these trends and conditions affect mortgage markets. Commentary is usually released in the middle of the month. For more information, click https://www.mba.org/news-research-and-resources/research-and-economics/forecasts-and-commentary.)