MBA Chart of the Week: Year over Year Change in Home Purchase Applications

Source: MBA Weekly Applications Survey.

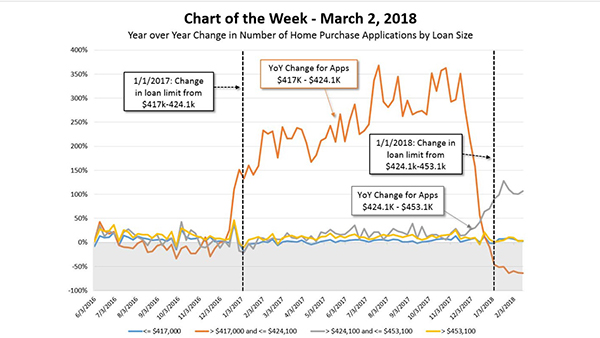

According to analysis of the Mortgage Bankers Association’s Weekly Applications Survey, mortgage applications for home purchase loans with amounts at or near the conforming loan limit have seen sizable swings in the past few years as increases to the conforming loan limit took effect.

Effective January 1, 2017 the Federal Housing Finance Agency increased its baseline conforming loan limit for the first time in more than 10 years, from $417,000 to $424,100. As a result, year over year growth in home purchase applications with loan amounts between $417,000 and $424,100 (orange line) averaged 237% throughout 2017, based on the number of loans.

One year later on January 1, 2018, FHFA increased the baseline conforming loan limit again from $424,100 to $453,100. Similarly to 2017, volume of applications between the existing and new loan limits ($424,100 and $453,100, grey line) has grown at an average rate of 105% since the new limit went into place eight weeks ago, but so far demand in 2018 has not been as strong for these borderline loans as it was in 2017.

Since both changes were announced well in advance of the January 1 effective date, and the source data measures loan applications, not closed loans, we see applications for the affected loan sizes take off in December prior to each change. Demand for loans between $417,000 and $424,100 (the 2016 and 2017 limits, orange line) has decreased substantially in 2018 suggesting that there was “bunching” near the 2017 loan limit.

Bunching occurs when borrowers with more expensive homes use larger down payments in order to keep loan size below the conforming threshold. Once the threshold increases, similar owners can take out commensurately larger loans, reducing demand right below the old threshold.

(Brennan Zubrick is senior financial reporting and data management analyst with MBA; he can be reached at bzubrick@mba.org.)