MBA Chart of the Week: Flash Polling Survey of Community Banks, Credit Unions

Source: MBA/CBCU Flash Polling Survey, Mar. 13

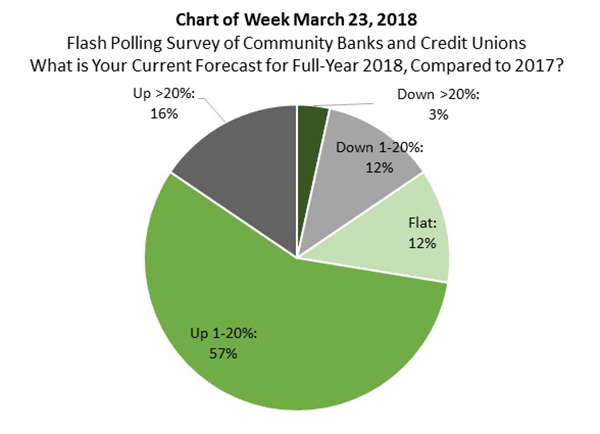

During the Community Bank and Credit Union Monthly Networking call on March 13, MBA surveyed mortgage executives on their anticipated production volume ($) for full-year 2018 compared to 2017.

Fifty-seven percent of survey participants said 2018 production volume would be up 1-20 percent from the previous year and another 16 percent responded production volume would be up more than 20 percent. Only 15 percent of survey participants responded that annual production volume would drop in 2018.

These CBCU Flash Polling Survey results are not consistent with MBA’s Industry Forecast for 2018. The Current MBA Industry Forecast as of March 20 has industry volume at $1.61 trillion in 2018 from $1.71 trillion in 2017, a 5.8 percent volume decrease. Should results of this survey and the MBA forecast hold, the overall industry volume decrease would be borne by other industry segments such as larger banks or independent mortgage companies.

The sample for the CBCU Flash Polling Survey included 58 participating companies of which 83 percent had bank assets of less than $10 billion and 92 percent had average production volume of less than $5 billion.

If you are with a community bank or credit union and are interested in participating in the monthly CBCU member networking calls, please contact Joe Palank at jpalank@mba.org.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Jon Penniman is Research Associate & Programmer with MBA Research & Economics; he can be reached at jpenniman@mba.org.)