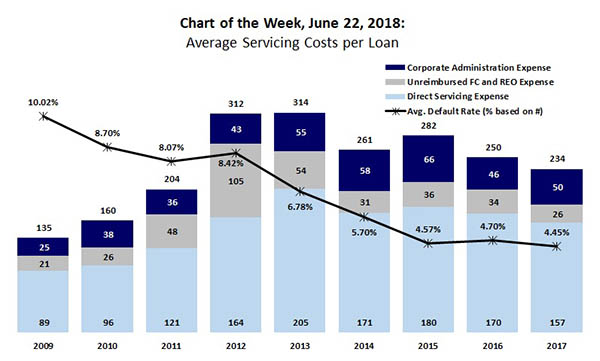

MBA Chart of the Week: Average Servicing Costs Per Loan

Source: MBA Servicing Operations Study and Forum.

Fully loaded servicing costs for single-family loans dropped in 2017 for the second consecutive year to $234 per loan, according to the latest MBA Servicing Operations Study.

The drop was driven by a lower direct cost to service, as well as lower unreimbursed foreclosure and real estate owned costs. Despite these modest improvements, costs were elevated compared to pre-2012 levels despite a substantially lower average default rate-historically, the primary driver of servicing costs.

For example, in 2009, the average default rate was over double what it was in 2017 at 10.02 percent compared to 4.45 percent in 2017, but the cost to service was $135 per loan in 2009.

Costs associated with servicing loans include three major components: 1) direct costs to service for such functions as call center, servicing systems, escrow, cashiering, investor reporting, collections, loss mitigation, other default functions and servicing management; 2) unreimbursed foreclosure and REO costs which cover servicer penalties, compensatory fees as well as mortgage product-specific foreclosure costs for which the servicer is responsible, such as a portion of the attorney fees for FHA loans; and 3) corporate costs for network administration, legal, finance, human resources, parent allocations and executive functions.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org.)