MBA Chart of the Week: Share of New Home Purchase Applications

Source: MBA Builder Applications Survey (https://www.mba.org/news-research-and-resources/research-and-economics/single-family-research/builder-applications-survey).

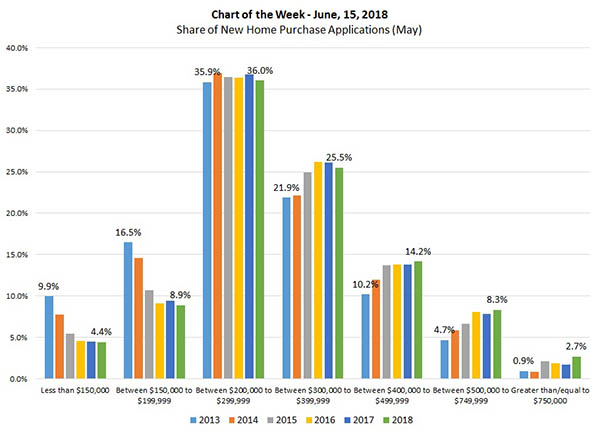

The Mortgage Bankers Association’s Builder Applications Survey tracks applications received by lenders affiliated with, or who work in cooperation with, home builders on new single family properties. The chart shows the share of new home applications for the month of May, by loan size category, for the past six years.

The chart illustrates that the share of applications for loan amounts greater than $300,000 has been consistently ticking up over the past few years. The share of applications for loan amounts between $500,000 and $749,999 has nearly doubled from 4.7 percent in May 2013 to 8.3 percent this May, while the share of applications for loans greater than $750,000 has tripled from 0.9 percent to 2.7 percent. Conversely, the share of applications for loans less than $150,000 and between $150,000 and $199,999 have approximately halved over the same period.

As this distribution in loan amounts have changed, affordability for the entry level home buyer has become increasingly more difficult. The share of sales to first time home buyers was 34 percent in 2017 and that has decreased to 30 percent of sales as this past March, according to the National Association of Realtors.

Despite strong demand for housing, builders have not been able to ramp up the supply of new homes, especially in the lower price tier of the market, as they face challenges in the acquisition of land, rising costs of lumber and having to raise wages to fill open positions.

(Joel Kan associate vice president of economic and industry forecasting with MBA; he can be reached at jkan@mortgagebankers.org. Anh Doan is senior financial analyst with MBA. She can be reached at adoan@mortgagebankers.org.)