MBA Chart of the Week: Refinance Index and 30-Year Fixed Rates

Source: MBA Weekly Applications Survey.

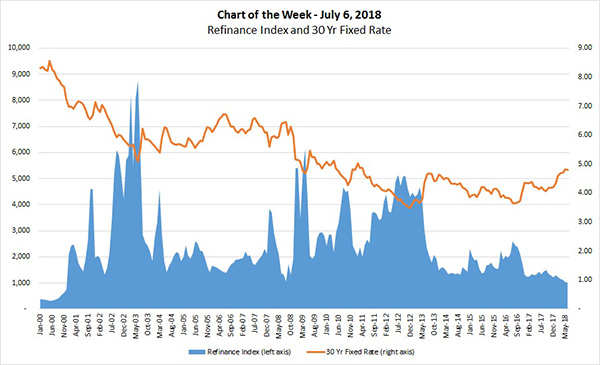

Mortgage refinance activity has declined through 2018 as rates have increased, reducing the incentive for borrowers to refinance, especially rate/term refinances.

MBA’s Weekly Applications Survey refinance index averaged 1,013 in June, the lowest monthly average since December 2000. The weekly index value dropped below 1,000 in three of the past six weeks, a level that it has not gone below since December 2000 as well.

The rate on a 30-year fixed rate mortgage, which averaged 4.81 percent in June, has increased by nearly 50 basis points in 2018 to date; compared to a recent low of 3.65 percent in July 2016, the rate is up by nearly 120 basis points. As a result, more than 90 percent of conventional loans outstanding do not have a strong incentive for a rate/term refinance.

Given that rate/term refinancing has declined, the share of cash-out refinances has increased, with Freddie Mac reporting nearly 70 percent of recent refinance activity was for the purpose of a cash-out, which is defined as a borrower taking out a new loan that is at least 5 percent greater than the previous loan amount.

MBA’s forecast is for rates to continue to increase this year, driven by strong economic growth, a hot job market and greater inflationary pressures. We expect the 30-year rate to reach 5 percent by the end of 2018–and as a result, cause refinance volume to drop 23 percent in 2018 compared to 2017.

(Joel Kan is associate vice president of economic and industry forecasting with MBA; he can be reached at jkan@mba.org).