MBA Chart of the Week: Consumer Direct Channel, Net Production Income

Source: PGR–MBA and STRATMOR Peer Group Roundtables.

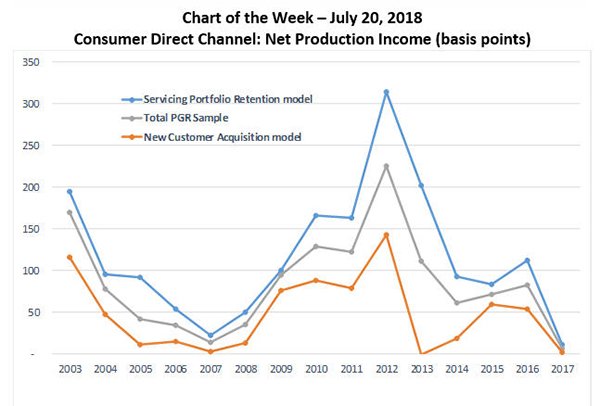

Production revenues, expenses, personnel and other metrics are divided into four major production channels in the MBA and STRATMOR Peer Group Roundtables data: Retail, Consumer Direct, Broker Wholesale and Correspondent. For this week’s chart, we focus on the trending of net production income for the Consumer Direct channel.

In the Consumer Direct channel, loans are typically originated through a centralized call center with mortgage applications generated through purchased leads, direct mail, telemarketing, media (radio, TV, print, web ads) or referrals from intermediaries such as one’s own retail bank or servicing shop.

Mortgage companies may use the Consumer Direct channel primarily as a refinancing outlet for their existing servicing customers or they may use the channel to generate business from new customers. Companies with more than 50% of total Consumer Direct loan volume from existing servicing customers are in the sub-group called “Servicing Portfolio Retention model.” Other companies are in the sub-group called “New Customer Acquisition model.”

For all groups, the peaks in net production income came during heavy refinance markets (e.g. 2003 and 2012). Some companies struggled in heavy purchase markets to either right-size for diminished volume or grow in scale from a start-up mode and/or gain traction in the competitive business of acquiring new and typically purchase customers.

Net production income for the Consumer Direct channel includes all related production revenues (fee income, gain on sale, servicing values, net warehouse spread) less sales and fulfillment expenses as well as allocated production support and corporate expenses.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org.)