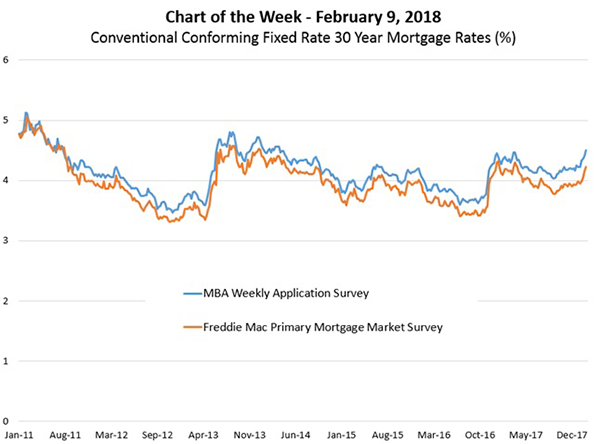

MBA Chart of the Week: Conventional Conforming Fixed-Rate 30-Year Mortgage Rates

Source: MBA; Freddie Mac.

Each Tuesday, the MBA Weekly Application Survey collects data from lenders on average contract interest rates for conforming 30-year fixed-rate mortgage applications (both purchase and refinance) processed during the prior week. We report those results on Wednesday mornings.

Freddie Mac also surveys lenders about contract rates on 30-year fixed-rate conforming purchase mortgages by asking about rate quotes from Monday-Wednesday each week and reports those results on Thursday of the same week the data ae collected. As can be seen in this week’s chart, MBA’s rates are consistently higher over the post-recession period. The spread varies, but the rates are still highly correlated.

Besides differences in timing, MBA collects information about refinance applications while Freddie does not, and MBA obtains average rates on actual applications while Freddie asks about the most popular rate a borrower could expect to be quoted. In addition, lender composition and weighting differs between the two samples. MBA’s survey also covers jumbo loans and those are presented as a separate series.

Freddie reported conforming rates were up 10 basis points at the beginning of the week ending Feb. 9 (to 4.32 percent). MBA’s comparable average rate, when published Feb. 14, may not change by the same amount from last week’s 4.5 percent because of the differences mentioned above.

(Michael Fratantoni is chief economist and senior vice president of research and economics with the Mortgage Bankers Association. He can be reached at mfratantoni@mba.org. Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan is associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org.)