MBA Chart of the Week: Homeowners Equity in Real Estate

Source: Federal Reserve.

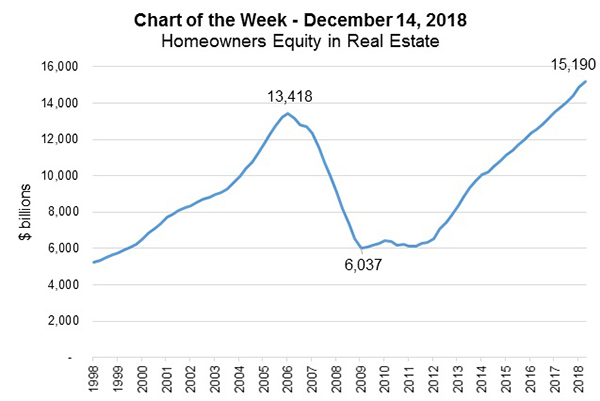

In the second quarter, homeowners’ equity in real estate reached $15.2 trillion and continued a run of consecutive increases dating back to 2010. This new peak was about 13 percent higher than the previous high of $13.4 trillion reached in 2006, and more than two and half times greater than the low point of $6 trillion during the recession in 2009.

This is a result of strong home price growth in many areas of the country, as well as the efforts of households to pay down the principal balance of their mortgage, helped by periods of low rates and a healthy job market.

As expressed by MBA President and CEO Bob Broeksmit, CMB, in his recent blog post: “The ability to access home equity provides many beneficial purposes for homeowners, including having additional cash to make home renovations, pay for a child’s education, supplement retirement income, pay down other high-interest debt or invest in growing a business.”

With the home equity lending market poised for growth, MBA is initiating a new Home Equity Lending Study in 2019 for originators and servicers of home equity loans and home equity lines of credit.

The study will cover commitment volume; applications data; a portfolio activity roll-forward; portfolio mix; transaction terms on existing contracts, risk management and repayment; operating structures; and overall lender sentiment on the business.

Please email mbaresearch@mba.org for more information or to participate.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Joel Kan is associate vice president of economic and industry forecasting with MBA; he can be reached at jkan@mortgagebankers.org.)