Dealmaker: JLL Secures $553M for Hotel, Retail

JLL, Chicago, secured $552.5 million for hotel and retail assets in Boston and New York.

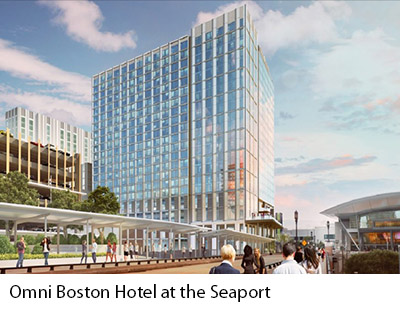

In Boston, JLL Managing Directors Kevin Davis and Bob Webster and Executive Vice President Jon Schneider led the team that closed a $330.7 million financing to construct Omni Boston Hotel at the Seaport, a 1,055-room hotel connected by underground tunnel to the Boston Convention and Exhibition Center in the Seaport District.

In Boston, JLL Managing Directors Kevin Davis and Bob Webster and Executive Vice President Jon Schneider led the team that closed a $330.7 million financing to construct Omni Boston Hotel at the Seaport, a 1,055-room hotel connected by underground tunnel to the Boston Convention and Exhibition Center in the Seaport District.

New Boston Hospitality, an affiliate of The Davis Cos. and Omni Hotels & Resorts, received the loan from a syndicate led by U.S. Bank, Santander and M&T Bank.

The project, slated for completion in early 2021, will become the fourth-largest hotel in Massachusetts upon delivery.

“Lodging supply growth in the Seaport District has been minimal,” Schneider said. “The addition of Omni Boston Hotel at the Seaport will meet demand and solidify Boston as a premier convention destination.”

In Brooklyn, N.Y., JLL Managing Director Jonathan Schwartz, Vice Chairman Aaron Appel and Executive Vice President Michael Diaz arranged a $221.8 million bridge loan through J.P. Morgan Chase to finance a portfolio of retail properties owned by RedSky Capital and JZ Capital Partners.

The portfolio includes 15 retail properties on highly trafficked retail corridors North 6th Street and Bedford Avenue.

“This three-year interest-only bridge loan will allow our client to refinance, acquire and fund capital improvements on this collection of well-located retail assets,” Schwartz said.

Schwartz said four of the properties on North 6th Street are being added to the portfolio through acquisition as a result of the financing. Three of the properties, all on North 6th Street, are fully leased to tenants including Urban Outfitters, Vans, Everlane and Aland. The remaining properties are in the process of being improved and leased.