With MBA Push, Minnesota Becomes Final State to Adopt Uniform State Test

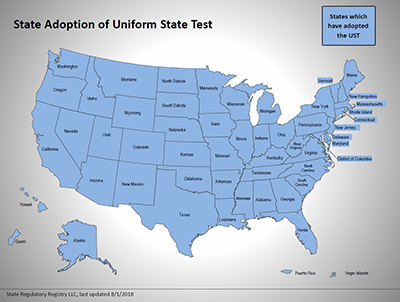

There are “red” states; there are “blue” states; there are even “purple” states. But on one map used by the Mortgage Bankers Association, the states are all one color.

Yesterday, Minnesota became the final U.S. state to adopt the Uniform State Test, a single nationwide exam for licensing mortgage loan originators. Minnesota’s adoption marks the culmination of more than five years of work by the Mortgage Bankers Association to streamline the licensing process for MLOs nationwide.

“Many of our members operate in multiple states,” said William Kooper, MBA Vice President of State Government Affairs and Industry Relations, whose department worked closely with federal regulators, state legislatures and state and local lending associations in adopting the UST. “Having multiple testing requirements [was] inefficient, time-consuming and costly for mortgage lenders and mortgage loan originators. The UST reduces costs for state regulated mortgage companies without jeopardizing important consumer financial protections that have already been enacted in states.”

“Many of our members operate in multiple states,” said William Kooper, MBA Vice President of State Government Affairs and Industry Relations, whose department worked closely with federal regulators, state legislatures and state and local lending associations in adopting the UST. “Having multiple testing requirements [was] inefficient, time-consuming and costly for mortgage lenders and mortgage loan originators. The UST reduces costs for state regulated mortgage companies without jeopardizing important consumer financial protections that have already been enacted in states.”

MBA has long-argued that for regulatory issues, less is more. It also recognized that a patchwork of state regulations, often with conflicting or contradictory provisions, are potentially more problematic for multi-state mortgage lenders and servicers than a uniform federal regulation. In 2011, MBA proposed a model bill for states to adopt a transitional licensing option for mortgage loan originators. Several states, including Ohio, North Carolina and Virginia, passed bills using the MBA language.

MBA also threw its support behind the UST, developed in 2012 by the Nationwide Mortgage Licensing System, the system of record for non-depository, financial services licensing or registration in participating state agencies, including the District of Columbia and U.S. Territories of Puerto Rico, the U.S. Virgin Islands and Guam. The NMLS, created in 2008 by the Conference of State Bank Supervisors and the American Association of Residential Mortgage Regulators, is owned and operated by the State Regulatory Registry LLC, a wholly owned subsidiary of CSBS.

The UST represented the first major change to SAFE Act MLO test requirements since the SAFE Act took effect in 2009. Kooper said the UST represented a necessary step forward; up to that point, each state had its own licensing test and education requirements.

The UST is a new domain or section in the National Test. It includes 25 questions that brings the length of the National Test Component with Uniform State Content to 125 questions, of which 115 are scored and 10 are unscored. The UST material tests applicants on their knowledge of high-level state-related content that is based on the SAFE Act and the CSBS/AARMR Model State Law that many states used to implement the SAFE Act.

The UST replaces the state-specific test components for the states that adopt it. Therefore, a passing result on the National Test with Uniform State Content satisfies the testing requirements for licensure in those adopting states.

In a message to MBA independent mortgage bankers and its state and local associations, MBA Senior Vice President of Residential Policy and Member Engagement Pete Mills said the five-year effort across 59 different licensing jurisdictions was a “daunting task.”

“Many state regulators were reluctant to give up ‘their’ test,” Mills said. “Some groups whose members only operate in one state saw the UST as a competitive threat. We beat back that opposition state by state and we now have a uniform nationwide testing standard. We were successful only because of the hard work of the state and local mortgage banking associations and volunteer advocates among our member companies.”

Mills noted the UST campaign is part of a broader MBA effort to rationalize and improve the patchwork of state licensing and regulatory requirements that IMBs face. Earlier this year, MBA also led the effort to secure passage of the “transitional authority” provisions in S. 2155, removing artificial barriers for IMBs in recruiting MLOs that work for depository institutions, and allowing easier licensing of MLOs from state to state. “We are now hard at work on implementing those provisions and encouraging states to adopt early,” he said.

And for Kooper and his department, there is another map to fill: MBA and the American Land Title Association are working on another 50-state campaign to adopt their joint model remote online notarization legislation. That effort, which has incubated over the past year, kicked off in earnest this past January and has already resulted in four states adopting measures consistent with the MBA/ALTA model bill, with several other states in active development.

For more information about the RON initiative, visit https://www.mba.org/audience/state-legislative-and-regulatory-resource-center/remote-online-notarization.