MBA Chart of the Week: Mortgage Originations 2008-2018

Source: MBA Forecast.

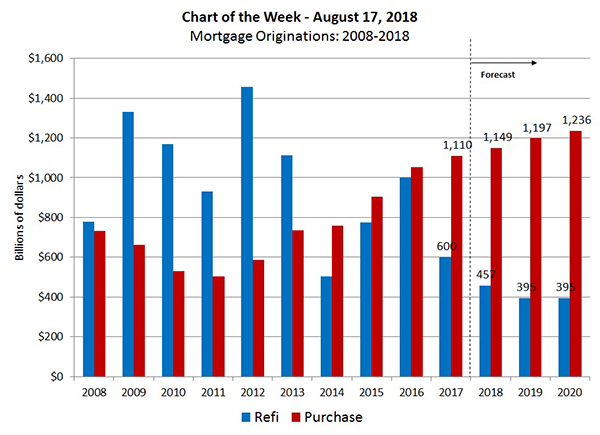

This week’s chart highlights the MBA mortgage originations forecast through 2020.

As a result of weaker data and lower expectations for home starts and sales, along with slower home purchase application activity from our Weekly Applications Survey, we revised our forecast for purchase originations lower in this month’s forecast. Purchase applications have started to show year over year decreases over the past few weeks, hampered by inventory and affordability issues.

We now expect $1.15 trillion in purchase originations in 2018, a 3.5 percent increase over 2017, and for that to grow around 4 percent in 2019 and 3 percent in 2020 to $1.2 trillion for each of those years. While 2018 would still be the strongest year for purchase originations since 2006, the level is lower than expected, given the strength of the economy and housing demand fundamentals.

Trade tensions and concerns over a Turkish currency meltdown have kept rates lower in recent weeks, but positive economic data releases still dominate and should move rates higher. The 30-year fixed mortgage rate is expected to reach 4.8 percent at the end of 2018 and 5.2 percent by the end of 2019. This rising rate path is likely to cause refinance originations to continue to decline through 2020, as many borrowers have already refinanced in lower rate periods back in 2012-2013 and 2014-2016. There is a much lower incentive to refinance at current rates, unless there is a desire for a cash out refinance.

(Joel Kan is associate vice president of economic and industry forecasting with MBA; he can be reached at jkan@mba.org.)