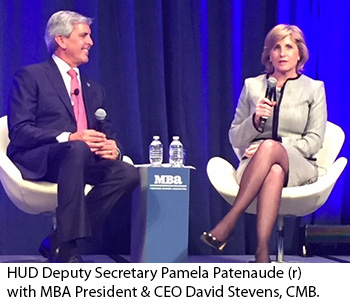

Patenude: HUD, FHA ‘Working Hard’ to Meet Challenges

WASHINGTON–HUD Deputy Secretary Pamela Hughes Patenaude has had a busy seven months. Two weeks after her confirmation this past summer, the first of several devastating hurricanes struck Texas, followed by another in Florida and a third in Puerto Rico. Then came the California wildfires.

Patenaude said she expects FHA to continue to play its countercyclical role in the mortgage market, but she conceded the disasters in Texas, Florida and Puerto Rico in particular have left FHA with a “huge amount of exposure.”

“We’re working hard to shorten the runway,” Patenaude said here at the Mortgage Bankers Association’s National Advocacy Conference. “I think we’ve improved as we’ve moved along.”

“We’re working hard to shorten the runway,” Patenaude said here at the Mortgage Bankers Association’s National Advocacy Conference. “I think we’ve improved as we’ve moved along.”

Patenaude said future mortgage insurance premium increases–or decreases–will depend on how well FHA can remain below its congressionally mandated 2 percent capital threshold.

Patenaude said despite criticism of HUD’s role in the Trump Administration–she termed reports of dysfunction at the agency as “fake news”–and challenges the department faces, she said HUD’s focus has been on helping people and formalizing priorities for FHA and other HUD programs. “I can tell you that I haven’t seen this ‘dysfunction’ that you see in the news,” she said. “We are working hard and we are moving forward.”

Patenaude, who previously served in HUD during the George W. Bush Administration, said modernizing HUD is a major priority.

“One thing that has not changed in the 10 years that I was last at HUD is the technology,” Patenaude said. “The Department’s Fiscal 2019 budget would allow us to charge a $25 fee per loan that would be set aside to improve our technology infrastructure, and we’re hopeful that Congress will approve it,” she said. “It’s a very high priority for the Secretary [Ben Carson]. We have ‘paper caves’ across the country, hundreds of thousands of binders. We need to go paperless so we can modernize our processes.”

Patenaude said she sees a place at the table for FHA in housing finance reform–with a catch. “I can’t imagine this President [Trump] won’t do something regarding housing finance reform, but he can’t do this without Congress, and they are running out of time,” she said. “There are things that HUD can do, but there has to be a willingness on the part of Congress.”

Patenaude said HUD and the industry must embrace a “balanced” homeownership policy. “It was never our intent during the Bush Administration to have ‘homeownership at any cost,'” she said. “Our goal was to encourage minority homeownership.”

Patenaude said she welcomes help from the real estate finance industry. “We need to improve our industry outreach,” she said. “It’s nice to leave a message with the President of the Mortgage Bankers Association [David Stevens, CMB, a former FHA Commissioner] and have him return your call immediately.”