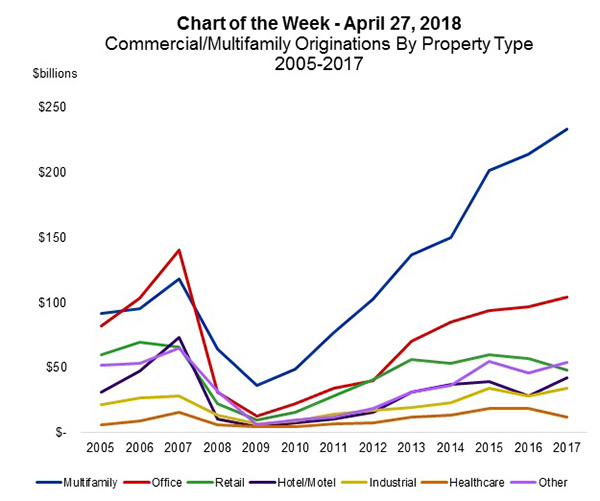

MBA Chart of the Week: Commercial/Multifamily Originations by Product Type 2005-2017

Source: MBA CREF Database.

Loans backed by multifamily apartment buildings have contributed an increasing share of mortgage bankers’ commercial and multifamily mortgage originations in recent years.

Multifamily property loans accounted for 44 percent of closed loan activity in 2017 (compared to 23 percent a decade earlier), followed by office properties at 20 percent, retail properties at 9 percent, hotel/motel properties at 8 percent, industrial at 6 percent, and health care at 2 percent. Ten percent of mortgage bankers’ originations were backed by other property types.

The average loan size was greatest for hotel/motel properties: $59.1 million per loan, followed by office buildings at $33.6 million, $18.0 million for health care, $13.8 million for retail properties, $12.7 million for industrial, and $12.3 million for multifamily properties. Other property types averaged $28.5 million per loan.

For information about the CREF Database, including member subscriptions, click https://www.mba.org/news-research-and-resources/research-and-economics/commercial/multifamily-research/commercial-real-estate/multifamily-finance-database.

(Jamie Woodwell is vice president of commercial/multifamily research and economics with the Mortgage Bankers Association. He can be reached at jwoodwell@mba.org. Reggie Booker is associate director of commercial/multifamily research with MBA; he can be reached at rbooker@mba.org.)