MBA Chart of the Week: Cash-Out Refinance Activity

Source: Freddie Mac.

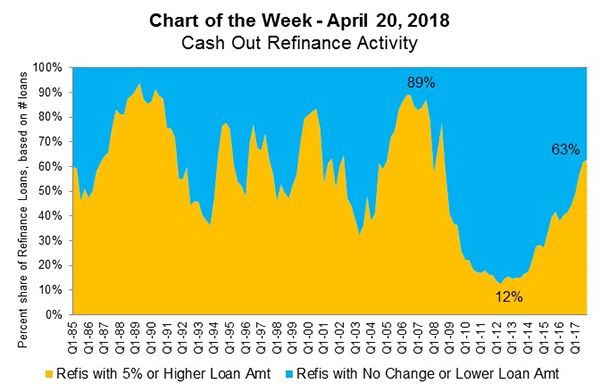

As of the fourth quarter, 63 percent of Freddie Mac refinance loans were cash-out refinances, based on data from its Quarterly Refinance Statistics (http://www.freddiemac.com/research/datasets/refinance-stats/index.html).

A cash-out refinance is defined as a refinance mortgage that resulted in a loan amount 5 percent or greater than the previous loan amount. The fourth quarter result of 63 percent represented an increase over a 62 percent share in the third quarter and 44 percent in fourth quarter 2016, but was still lower than a recent peak of 89 percent in 2006.

Part of the rise in cash-out activity can be attributed to increased home price appreciation, which helped to improve owners’ home equity positions. It is also important to note that over the year, industry refinance origination volume fell 42 percent according to MBA estimates, since most borrowers took advantage of multiple periods of lower rates in prior years. Therefore, there was a great drop off in rate/term refinancing, which increased the cash-out share.

Our forecast is for rates to continue to increase, reaching 5 percent by early 2019, so cash-out refinances will likely remain a significant share of refinance activity going forward, possibly getting back to almost 90 percent as we saw in previous peaks. As we showed in a previous chart, owners’ equity in real estate as of the end of 2017 was higher than the 2006 peak, and increased 90 percent over the past five years, so there is sufficient equity available to be used. (https://www.mba.org/publications/insights/archive/mba-insights-archive/2018/mba-chart-of-the-week-homeowners-equity-and-home-equity-loans?_zs=WqkwB1&_zl=ohFK4)

(Joel Kan is associate vice president of economic and industry forecasting with MBA; he can be reached at jkan@mba.org).