MBA Chart of the Week: IMB Total Production Expenses per Loan

Source: MBA Quarterly Mortgage Bankers Performance Report.

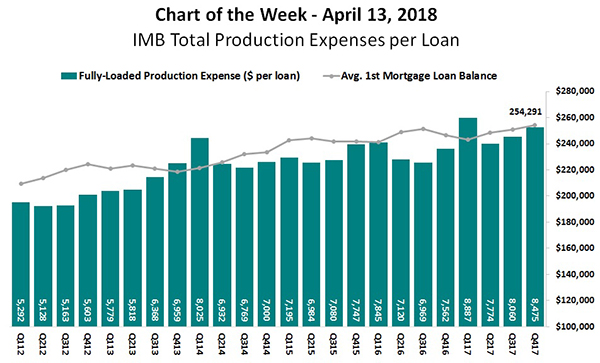

Based on the Mortgage Bankers Association’s latest Quarterly Performance Report, independent mortgage bankers’ total loan production expenses–commissions, compensation, occupancy, equipment and other production expenses and corporate allocations–increased to $8,475 per loan in the fourth quarter, from $8,060 in the third quarter.

This marks the second-highest level reported since inception of our study in 2008.

The higher production costs in the fourth quarter were likely driven by several factors. During this quarter, average production volume by count per company averaged 2,059 loans, down from 2,341 loans in the third quarter. Fixed sales, fulfillment, support and corporate costs were spread over fewer loans, increasing per-loan costs.

In addition, loan balances continued to rise, reaching a study high of $254,291. Since sales compensation is usually a percentage of the average loan balance, sales personnel costs per loan generally rise with increasing loan balances. Other factors influencing production costs may include rising compliance-related costs, technology spending and non-sales labor costs for specific skillsets such as underwriting.

The report is available at www.mba.org/performancereport.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Jenny Masoud is research analyst with MBA; she can be reached at jmasoud@mba.org.)