MBA Chart of the Week: Quarterly Pre-Tax Net Production Profits 2008-2017

Source: MBA’s Quarterly Mortgage Bankers Performance Report

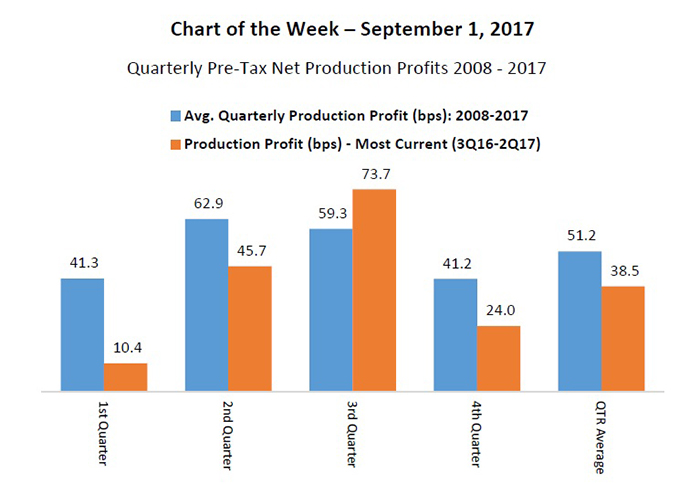

Independent mortgage banks and mortgage subsidiaries of chartered banks have typically had the highest profitability in the second quarter of the year. The second quarter is when the spring home buying season traditionally kicks in and purchase production volume tends to increase.

From 2008-2017, pre-tax production profits for the second quarter averaged 62.9 basis points, compared to 51.2 basis points across all quarters.

MBA’s most recent Quarterly Mortgage Bankers Performance Report, released Aug. 29 (https://www.mba.org/news-research-and-resources/research-and-economics/single-family-research/mortgage-bankers-performance-reports-quarterly-and-annual), shows pre-tax production profits for independent mortgage banks and mortgage subsidiaries of chartered banks averaged 45.7 basis points in the second quarter, falling short of the average for both second quarters and all quarters.

The first and fourth quarters have traditionally seen lower profitability. From 2008-2017, first quarter pre-tax production profits averaged 41.3 basis points, while fourth quarter production profits averaged 41.2 basis points. In the most recent quarters available, however, these profits were 10.4 basis points in the first quarter and 24.0 basis points in fourth quarter 2016. The second quarter thus marks the third consecutive quarter of lower production profits compared to historical quarterly averages.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Jenny Masoud is research analyst with MBA; she can be reached at jmasoud@mba.org.)