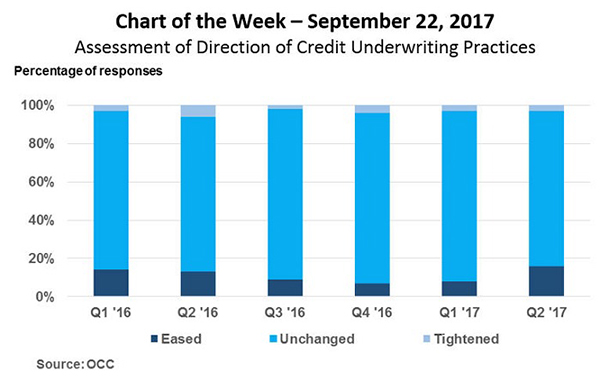

MBA Chart of the Week: Assessment of Direction of Credit Underwriting Practices

In 2016, the Office of the Comptroller of the Currency noted an incremental easing of underwriting standards, even though the pace of that easing slowed towards the end of the year. This week’s chart shows that easing of underwriting standards has resumed in 2017.

The survey includes “OCC examiners’ assessments of underwriting practices (customary activities including formal underwriting standards of risk acceptance) and quantity and direction of credit risk” for national banks and federal savings associations. The chart includes, among other lines, commercial and residential mortgage lending.

The OCC’s semiannual risk perspectives from the spring (https://www.occ.treas.gov/publications/publications-by-type/other-publications-reports/semiannual-risk-perspective/semiannual-risk-perspective-spring-2017.pdf) notes several key risks facing the federal banking system that are particularly relevant for the overall mortgage market. These include competitive pressures and operational risks.

These risks and many others will be the source of conversation this coming week as we arrive at the MBA Risk Management, Quality Assurance and Fraud Prevention Forum in Miami. Among the featured speakers will be Darrin Benhart, the OCC’s Deputy Comptroller of Supervision Risk Management.

Click for more information on the conference (https://www.mba.org/store/events/conferences-and-meetings/risk-management-qa-and-fraud-prevention-forum); and for opportunities to view the live stream (https://www.mba.org/store/events/conferences-and-meetings/live-stream-risk-management-and-quality-assurance-forum?utm_source=Informz&utm_medium=Email&utm_campaign=mba.org&_zs=olANA1&_zl=jvcx3).

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org).