MBA Chart of the Week: State Purchase Applications Indexes for FL and TX

Source: MBA Weekly Application Survey

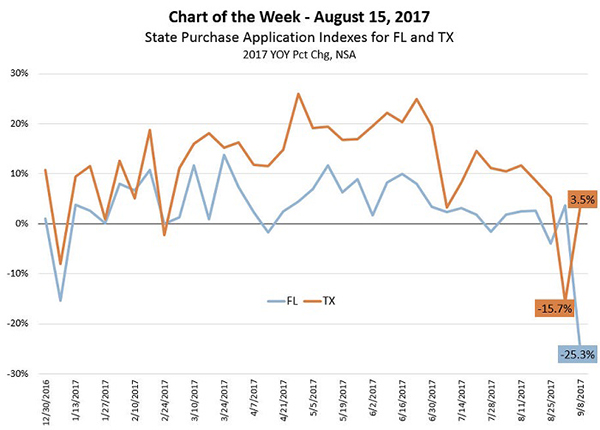

This week we take the pulse of the mortgage market in Texas and Florida to assess the on-going impact of hurricanes Harvey and Irma on mortgage application activity.

Making landfall in Texas on August 25, Harvey hung around for four days, dumping rain on Houston and the surrounding coastal areas. For the week following its initial landfall ending September 1, application activity in Texas declined by more than 15 percent compared to the same week the year before. The following week, which included Labor Day, applications rebounded to a 3.5 percent year over year gain on the back of presumably strong activity elsewhere in the state. Texas had experienced strong year over year growth in purchase mortgage activity prior to the hurricane.

Irma made landfall in the Florida Keys on September 10 before continuing up the west coast of Florida and heading inland, and in this week’s chart we see that widespread preparation and evacuations in Florida reduced mortgage applications by more than 25 percent before the hurricane arrived as business ground to a halt.

The storms differed in a variety of ways. Harvey was unprecedented in its rainfall for the coast of Texas and caused flooding that affected up to 30 percent of the state’s population, as measured by the population of counties in FEMA individual assistance areas. Irma brought high winds and flooding to a state that is much more prepared (and more widely insured) for such perils, but it affected nearly 90 percent of the state’s population, and more than twice the population of Harvey affected counties in Texas, as Irma engulfed the entire state in her path.

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org).