FHFA Adds ‘Preferred Language’ Question to Uniform Residential Loan Application

The Federal Housing Finance Agency on Friday said it would add a preferred language question to the redesigned Uniform Residential Loan Application, despite concerns by the Mortgage Bankers Association and the real estate finance industry.

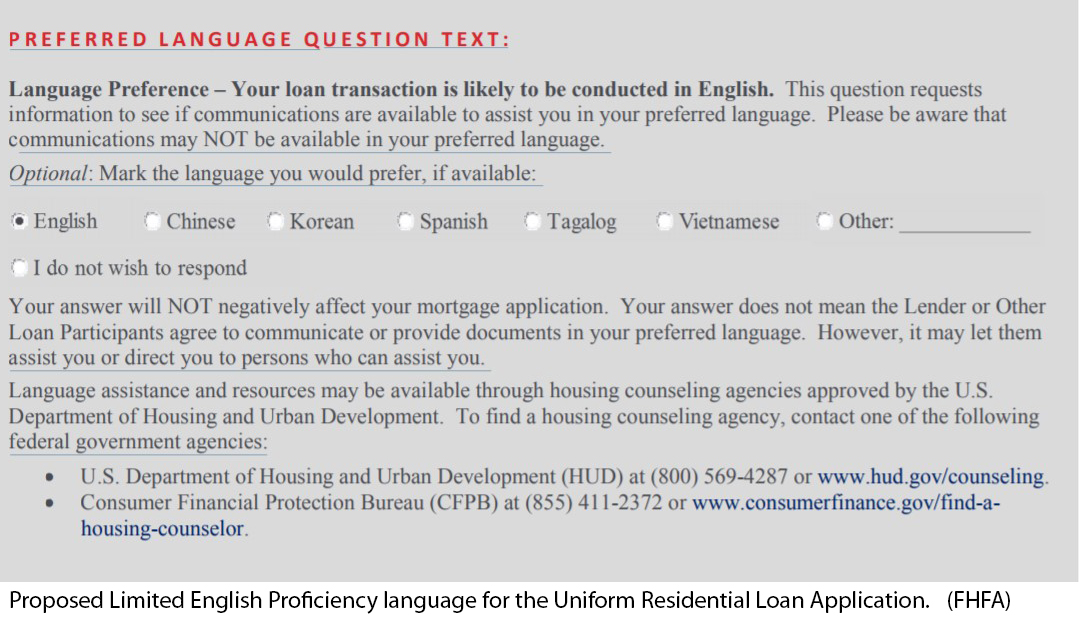

FHFA said (https://www.fhfa.gov/PolicyProgramsResearch/Policy/Documents/Preferred_Language_Question.pdf) the question will enable borrowers who prefer to communicate in a language other than English to identify that language. It also provides clear disclosures that the mortgage transaction is likely to be conducted in English and that language resources might not be available.

“Your loan transaction is likely to be conducted in English,” the preferred language question states. “This question requests information to see if communications are available to assist you in preferred language. Please be aware that communications may NOT be available in your preferred language.”

The text also notes: “Your answer does not mean the Lender or Other Loan Participants agree to communicate or provide documents in your preferred language. However, it may let them assist you or direct you to persons who can assist you.”

Later this year, Fannie Mae and Freddie Mac will publish the final redesigned URLA. Lenders may begin using the redesigned URLA in July 2019, but use of the redesigned form will not be mandatory for Enterprise loans until February 2020.

FHFA’s proposal of a Limited English Proficiency question in the URLA earlier this year spurred significant debate in the real estate finance industry. In August, MBA and other industry trade groups strongly urged FHFA to reconsider the proposed question, saying it would be problematic for mortgage lenders, subjecting lenders to “considerable legal risks” and “operational and customer service challenges.”

On Friday, MBA Senior Vice President for Residential Policy and Member Engagement Pete Mills said FHFA, while not eliminating the question, appeared to take the industry’s concerns into consideration.

“MBA and its members are committed to serving all borrowers in a safe and sustainable manner–including those with limited English proficiency,” Mills said. “While we continue to have significant reservations about including a language preference question on the URLA, we appreciate the modest improvements FHFA has made in response to industry feedback and concerns about the GSEs’ consumer testing. We are committed to working with FHFA, the Enterprises and other government agencies to continue developing resources to aid LEP borrowers.”

FHFA Director Melvin Watt said adding a preferred language question to the URLA “will enable mortgage industry participants to connect LEP borrowers to available language access resources. This will support access to credit for a growing segment of the nation’s housing finance market.”

Watt said following “robust stakeholder outreach and public feedback on its broader language access Request for Input,” FHFA took steps to address concerns raised about inclusion of a language preference question. These steps include adding disclosure language to the question to mitigate legal concerns raised by lenders, set appropriate borrower expectations about available language services, and inform borrowers about other language access resources.

FHFA said Fannie Mae and Freddie Mac will also publish a separate disclosure translated into several languages that further informs borrowers about the nature of available language resources. Use of this disclosure will be optional for lenders.