MBA Charts of the Week: 2016 HMDA Respondents

Source: 2011-2016 Home Mortgage Disclosure Act (HMDA)

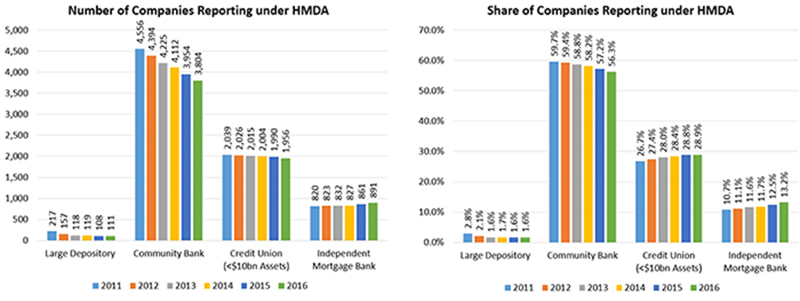

For calendar year 2016, a total of 6,762 institutions reported lending activity under the Home Mortgage Disclosure Act. Large depositories are defined as depository institutions with $10 billion or more in assets and community banks are defined as banks with less than $10 billion in assets.

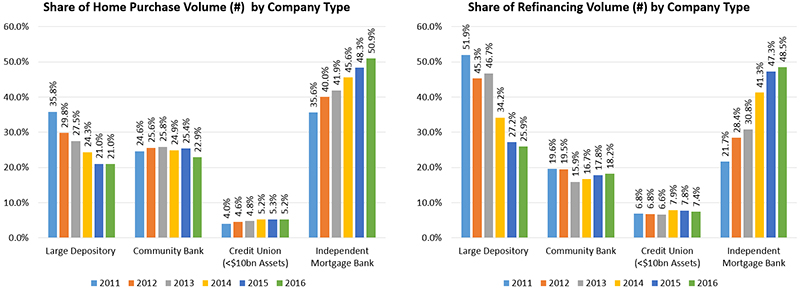

Large depositories were essentially unchanged in terms of the number of reporting institutions, but saw a decrease in their market share in terms of refinance mortgage originations (see next charts). The purchase share of originations for large depositories remained unchanged from 2015. Community banks saw a decrease in the number of companies reporting, likely due to continued consolidation in the industry, but an increase in refinance share of originations.

Independent mortgage banks increased in the number of reporting companies and also in their market share of both home purchase and refinance origination volume. Credit unions with <$10 billion in assets saw a very slight decrease in the number of companies and in their share of purchase and refinance originations.

Source: 2011-2016 Home Mortgage Disclosure Act (HMDA)

Volume charts are based on a set of exclusions that MBA imposes on the data, resulting in retail/broker first lien-only originations for home purchase of 1-4 unit homes, including manufactured homes. These criteria may result in differences from statistics reported elsewhere.

In 2016, IMBs continued their trend of gaining market share, increasing to 50.9 percent of purchase originations and 48.5 percent of refinance originations. IMBs have now had a higher share of refinance activity than large depositories for three years. Community banks increased their refinance share in 2016, increasing to 18.2 percent, their highest share since 2012.

Click to learn more about the 2017 MBA Residential Originations DataBook: https://www.mba.org/store/products/market-and-research-data/mba-2017-originations-databook-(with-2016-data).

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mortgagebankers.org. Brennan Zubrick is senior financial reporting and data management analyst with MBA; he can be reached at bzubrick@mba.org.)