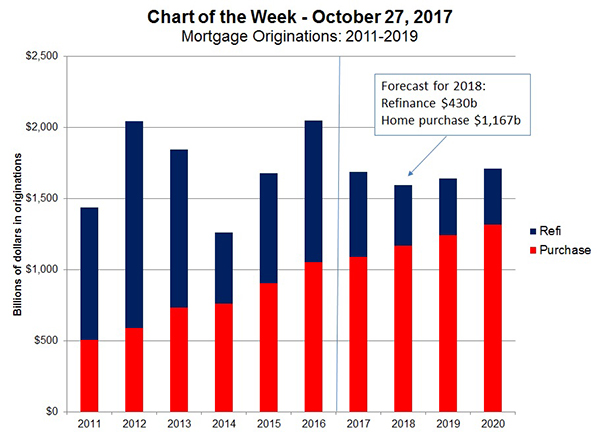

MBA Chart of the Week: Mortgage Originations 2011-2019

Source: MBA Mortgage Finance Forecast

The Mortgage Bankers Association’s most recent forecast released last week (http://mba-erm.informz.net/mba-erm/data/images/SFResearch-Forecast/Mtg Fin Forecast Oct 2017.pdf) estimates home purchase originations will increase at a faster clip in 2018, nearly double the rate that they increased in 2017, to $1.2 trillion.

In contrast, we expect refinance originations will decrease by 28.3 percent from 2017, to approximately $430 billion. In total, mortgage originations will decrease to $1.60 trillion in 2018 from $1.69 trillion in 2017.

All the pieces are in place for stronger growth in 2018 and beyond, although the housing market has been recently hamstrung by insufficient supply, with inventories of homes remarkably low given the home price growth we have experienced. The job market remains strong, demographic trends are quite favorable, mortgage credit is becoming more available to qualified borrowers, and home prices should continue to rise.

We expect the Fed will raise rates in December 2017, three times in 2018 and twice in 2019. The Federal Reserve has begun reducing its holdings of Treasury securities and mortgage backed securities, and this will put additional, modest upward pressure on mortgage rates. We expect that the 10-Year Treasury rate will stay below 3 percent through the end of 2018, and 30-year mortgage rates will stay below 5 percent.

In addition to the updated forward-looking forecast, MBA upwardly revised its estimate of originations for 2016 to $2.05 trillion from $1.89 trillion, to reflect the most recent data reported in the 2016 Home Mortgage Disclosure Act data release.

(Michael Fratantoni is chief economist and senior vice president of research and economics with the Mortgage Bankers Association. He can be reached at mfratantoni@mba.org. Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan is associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org.)