MBA Chart of the Week: Net Change in Households, by Structure Type and Tenure

Source: MBA-Adjusted Counts from Current Population Survey.

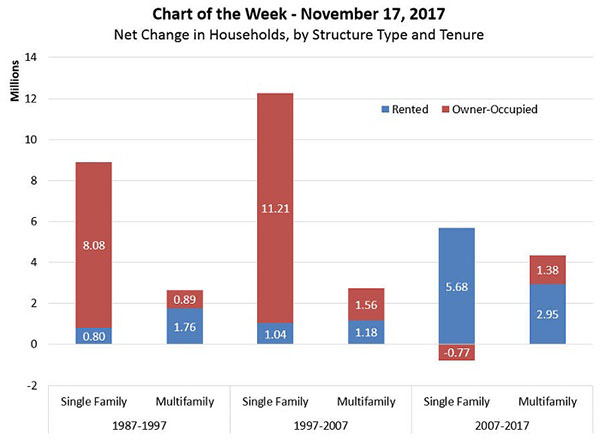

We tend to equate owner-occupied housing with single-family homes and renter-occupied housing with multifamily apartment complexes. And traditionally that was largely the case.

Between 1987 and 1997, for example, 90 percent of the growth in single-family housing was through owner-occupied households and two-thirds of the growth in multifamily housing was through renter households. The same generally held true from 1997 to 2007.

But the past decade has unfolded very differently. From 2007-2017, the number of single-family owner-occupied households declined by 770,000 and the number of single-family renters increased by 5.7 million, according to the Current Population Survey (adjusted for recent population estimate updates). Households living in multifamily units increased 50 percent faster than in prior decades. Only recently has net growth in single-family owner-occupied households turned positive again.

Falling home prices and rising rents tend to bring some owner-occupied units into rental tenure, while rising home prices and falling rents draw some of the single family rental stock back into owner-occupation over time (see RIHA study: https://www.mba.org/news-research-and-resources/research-and-economics/research-institute-for-housing-america/published-reports/2017/owned-now-rented-later-housing-stock-transitions-and-market-dynamics). Right now, however, both rents and prices have been rising, reflecting demand for both tenures.

Continued pressure on prices, from whichever source, should continue to provide incentives to build new homes to help relieve inventory shortages. The home building industry is facing a number of headwinds, however, that suggest that affordability will remain a challenge for the medium term until sufficient new supply is brought on line.

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Jamie Woodwell is vice president of commercial/multifamily research and economics with MBA. He can be reached at jwoodwell@mba.org.)