MBA Chart of the Week: U.S. Top Corporate & Income Tax Rates over Time

Source: Tax Policy Center

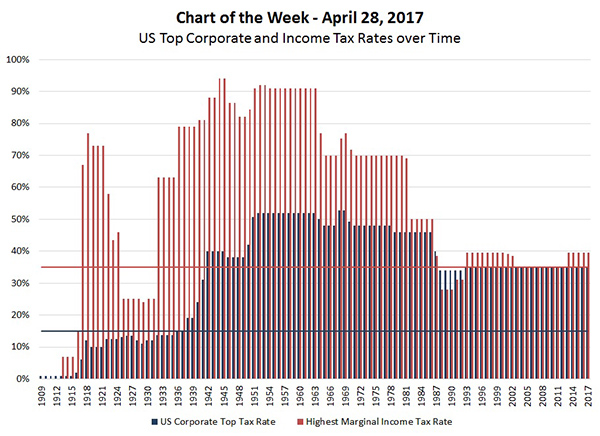

President Trump last week announced the broad outline of his tax plan. Our chart this week puts the top tax rate for both corporations and individuals in historic perspective.

In particular, the Trump tax plan calls for reducing the top corporate tax rate to 15 percent from a current maximum of 35 percent. At 15 percent, this would be the lowest top corporate tax rate since the late 1930s.

He is also advocating for lowering the highest individual marginal income tax rate from 39.6 percent to 35 percent, which was last the top rate back in 2012. At the same time, the plan calls for lowering the top tax rate for pass-through entities (such as limited liability companies and partnerships) to 15 percent, on par with the corporate rate.

A variety of deductions and credits are expected to come under scrutiny during tax reform as the impacts of any rate changes on the U.S. government’s budget will need to be addressed.

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org).