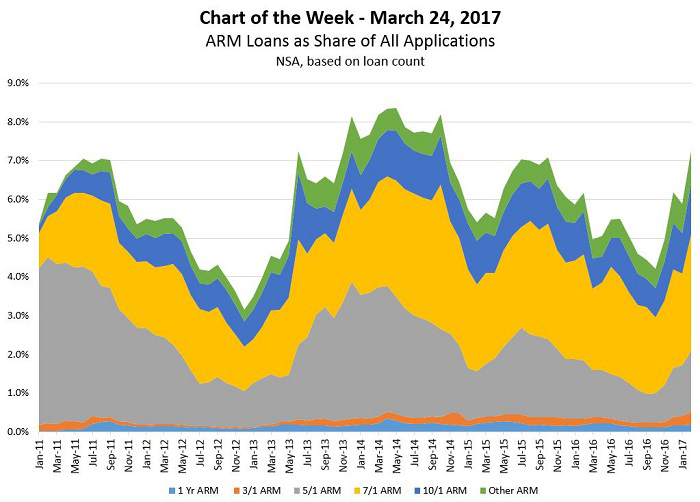

MBA Chart of the Week: ARM Loans as Share of All Applications

Source: MBA Weekly Application Survey

The adjustable-rate mortgage share of mortgage applications has increased to 7.2 percent of all applications in February, led by 7/1 ARMs and followed in share by 5/1 and 10/1 ARM products.

The ARM share has increased for both purchase and refinance applications, although in different contexts. In early 2017, purchase applications have been flat to slightly increasing on a year over year basis, but the number of purchase ARM applications increased at a more rapid rate. Over the same period, refinance applications fell on a year over year basis but refinance ARM applications did not decline as quickly, leading to an increase in share.

Historically, the ARM share has increased when entering a purchase market and as rates rise. Home buyers in a strong housing market tend to look for ways to extend their purchasing power, and ARMs are one way to do that. However, while the ARM share got as high as 35 percent pre-crisis, it is highly unlikely it will climb that far again given the Qualified Mortgage regulation that effectively prohibits many types of ARMs that were prevalent pre-crisis, and simply tighter credit in general. Additionally, mortgage rates are more than 2 percent lower than when the ARM share peaked.

(Michael Fratantoni is chief economist and senior vice president of research and economics with the Mortgage Bankers Association. He can be reached at mfratantoni@mba.org. Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org.)