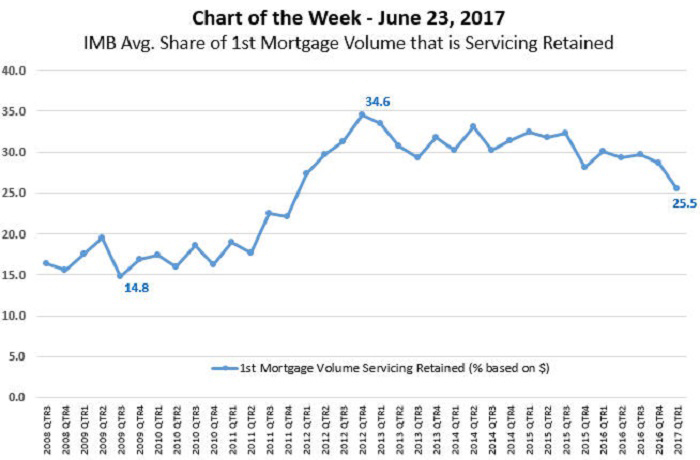

MBA Chart of the Week: IMB Average Share of 1st Mortgage Volume Servicing Retained

Source: MBA Quarterly Mortgage Bankers Performance Report

In the first quarter among independent mortgage companies and mortgage subsidiaries, the simple average percentage of closed first mortgage volume ($) that was servicing retained was 25.5 percent. This represents a drop of more than nine percentage points from the peak of 34.6 percent in fourth quarter 2012.

In 2012, when net production income was at its peak, servicing retention volume was also at its peak. As net production income fell, particularly in the last two quarters, servicing retention volume dropped, though it remains higher than pre-2012 levels. Factors affecting servicing retention include best execution, availability of funding for the mortgage servicing rights, cash on hand and taxation benefits, among others.

Servicing retention volume is defined as the percentage of closed loans in which the servicing rights related to those loans are kept by the originating mortgage company and a capitalized value of the servicing right is reported.

The inverse of servicing retention volume is servicing released volume, in which the servicing rights for the originated loans are sold to a third party in exchange for a servicing released premium. Common transactions for this arrangement include whole-loan sales (sales of the loans and servicing rights to correspondent lenders) as well as co-issue arrangements in which a mortgage company may sell the loan to Fannie Mae or Freddie Mac, for example, then transfer the servicing rights to another approved servicer.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org. Jenny Masoud is research analyst with MBA; she can be reached at jmasoud@mba.org.)