Stevens to Senate Committee: Without GSE Reform, All Face Risk, Uncertainty About Future

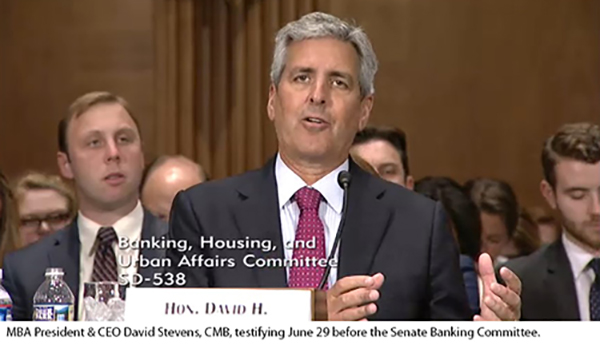

Mortgage Bankers Association President and CEO David Stevens, CMB, urged the Senate Banking Committee last week to take decisive action on secondary mortgage market reform, saying such reform must “foster a competitive primary market that is served by a diverse cross-section” of lending institutions.

“The financial crisis exposed the structural conflicts and misaligned incentives in the GSE business model, as well as weaknesses in the regulatory framework that was in place at the time,” Stevens testified. “Extended conservatorship is economically and politically unsustainable and an unacceptable long-term outcome. Without comprehensive reform, borrowers, taxpayers and lenders will all face increased risk and uncertainty about the future.”

“The financial crisis exposed the structural conflicts and misaligned incentives in the GSE business model, as well as weaknesses in the regulatory framework that was in place at the time,” Stevens testified. “Extended conservatorship is economically and politically unsustainable and an unacceptable long-term outcome. Without comprehensive reform, borrowers, taxpayers and lenders will all face increased risk and uncertainty about the future.”

The hearing, Principles of Housing Finance Reform, comes amid renewed energy on Capitol Hill to devise a solution for the secondary mortgage market and create new structures for Fannie Mae and Freddie Mac. Last week at the MBA National Advocacy Conference, Sen. Mark Warner, D-Va., said he and Sen. Bob Corker, R-Tenn., have renewed discussions in reviving elements of a GSE reform bill they authored in 2015.

Stevens appeared at the hearing at the request of Banking Committee Chairman Mike Crapo, R-Idaho, and Ranking Member Sherrod Brown, D-Ohio.

“Reform is urgently needed, and the Committee is actively exploring a variety of options,” Crapo said. “There are a number of principles that I believe share bipartisan support that we will explore further.”

Brown noted many questions remain. “As we try to achieve broad bipartisan consensus on a housing finance reform proposal, there are a number of open questions that need to be addressed,” he said. “How does each proposal avoid the kind of shareholder demand for returns that drove the worst decisions at the GSEs? How do the proposals prevent predatory mortgage products that targeted and stripped wealth from communities like Cleveland? How do we do a better job of prohibiting discrimination in the mortgage market?

Much of Stevens’ testimony (https://www.banking.senate.gov/public/_cache/files/51078e45-c3ea-49cd-95a2-d37c7b6ce75f/EAAB641A837ADCBDBEDC8D07FA54B095.stevens-testimony-6-29-17.pdf) centered on MBA’s detailed proposal released in April, GSE Reform: Creating a Sustainable, More Vibrant Secondary Mortgage Market (https://www.mba.org/issues/gse-reform). Stevens said the proposal, the result of the work of the MBA Task Force for a Future Secondary Mortgage Market, ensures equitable access for smaller lenders to the secondary market: prohibiting special pricing and underwriting based on loan volume as occurred prior to conservatorship, preserving cash window and small pool execution options and preventing vertical integration by the largest market participants.

“Our proposal recognizes the need for any comprehensive GSE reform plan to balance three major priorities: taxpayer protection, investor returns, and consumer cost and access to credit,” Stevens said. “To achieve these policy objectives, MBA’s plan recommends recasting the GSEs’ current charters and allowing a multiple-Guarantor model that features at least two entities and preferably more.”Under the MBA proposal, guarantors would be monoline, regulated utilities owned by private shareholders, operating in the single-family and multifamily markets.

“The core justification for utility-style regulation rests with the premise that privately owned utilities attract patient capital and derive much of their existence and powers from the state,” Stevens said. “The Guarantors would be subject to rigorous capital requirements that would provide financial stability without unduly raising the cost of credit for borrowers. These requirements could be satisfied through a combination of their own capital and proven means of credit risk transfer.”

Stevens said the implied government guarantee of Fannie Mae and Freddie Mac would be replaced with an explicit guarantee at the mortgage-backed security level only. This guarantee would be supported by a federal insurance fund with appropriately-priced premiums paid by the Guarantors.

“Our plan explicitly calls for deeper first-loss risk sharing that is transparent, scalable to all lenders and capable of limiting taxpayer exposure to nothing more than catastrophic risk,” Stevens said.

The Task Force also developed recommendations in two areas that have vexed past reform efforts: the appropriate transition to a new system and the role of the secondary market in advancing a national affordable-housing strategy.

“Our proposal specifically notes the importance of leveraging the assets, infrastructure and regulatory framework of the current system wherever possible,” Stevens said. “We also believe that any workable transition must utilize a clear road map and be multi-year in nature. We sought to develop an affordable-housing framework that appropriately focuses the scope of the federally-supported secondary market, covering both renters and homeowners of varying income levels.”

The result, Stevens added, would be outcomes that are “transparent, well-defined, measurable and enforceable.”

Stevens reiterated MBA’s assertion that only Congress can bring about the changes necessary to achieve the core principles outlined in the MBA plan.

“Now is the time for Congress to act to ‘lock in’ these improvements,” Stevens said. “After all, only Congress can alter the existing GSE charters, establish an explicit federal government guarantee and create a regulatory mandate to maintain a level playing field. And most importantly, only Congress can provide the legitimacy and public confidence necessary for long-term stability in both the primary and secondary mortgage markets. We cannot go back to a housing finance system that provides private gains when markets are strong yet relies on support from taxpayers when losses occur.”

Stevens dismissed calls by investor groups to recapitalize Fannie Mae and Freddie Mac. “Calls to simply recapitalize the GSEs and allow them to operate without further structural changes are misguided,” he said. “Under such plans, the post-crisis reforms already achieved could be reversed at the discretion of future [Federal Housing Finance Agency] directors. The American people rely on a housing finance system that enables them to rent a quality, affordable apartment, buy their first home or build a nest egg to pass on to their children. We owe it to them to proceed with the hard work of reform without delay.”