MBA Chart of the Week: Purchase Application Trends By Loan Size

Source: MBA Weekly Applications Survey

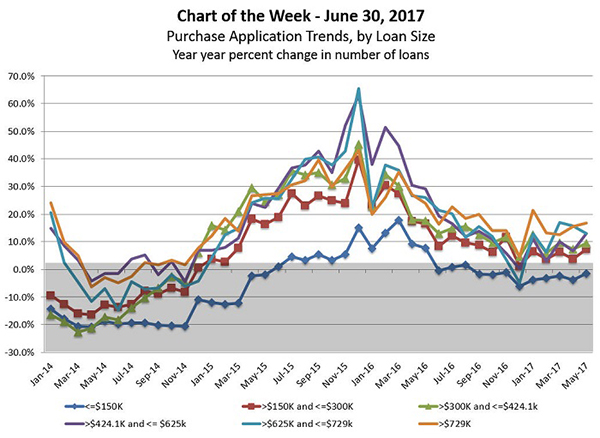

Mortgage applications for home purchase continue to grow at a faster pace for higher balance loans, according to data from the MBA Weekly Applications Survey.

In particular, growth rates for home purchase applications above the current conforming loan limit of $424,100 have generally outpaced those for applications with lower loan balances in 2017, although year over year growth rates have recently stabilized for all loan sizes.

After picking up steam in late 2015, applications with the smallest loan sizes ($150,000 or less) have failed to sustain their momentum due to various factors including tight inventories for lower priced homes.

Sixty-four percent of all purchase applications were for less than $300,000 in May, a size typical for applicants who are entry level and first time home buyers. More than a quarter of purchase applications were for between $300,000 and $625,000, with less than 10 percent of applications in our survey for loans in excess of $625,000.

Given the relative weights of these groups, total year to date growth through the third week of June in purchase applications was 4.4 percent relative to 2016.

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Brennan Zubrick is senior financial reporting and data management analyst with MBA; he can be reached at bzubrick@mba.org.)