MBA Chart of the Week: Hard-to-Fill Openings and Plans to Raise Compensation

Source: National Federation of Independent Businesses

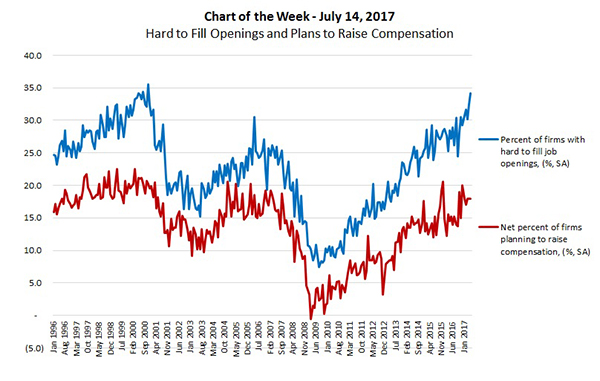

According to data from the National Federation of Independent Businesses, which tracks small business economic trends, 34.2 percent of surveyed firms reported that they had difficulties filling job openings in May. This was the highest level since 2000.

As shown in the chart, since hitting a low in 2009, this measure has increased steadily and is well above the historical average of 21.2 percent. We see this result as consistent with broader data on job openings and hiring from the Bureau of Labor Statistics, where job openings have exceeded hiring for more than a year with the exception of May.

While wage and compensation growth have seen relatively modest growth to date, job opening and hiring trends continue to suggest that wage and compensation growth will pick up further. As seen in the chart, there has been an upward trend in small firms planning to raise compensation.

In a separate BLS report, U.S. payrolls grew by 222,000 jobs in June and were accompanied by upward revisions to the prior two months’ results. In 2017 to date, average monthly growth is around 180,000 jobs, which is slightly below 2016’s average and comparable to 2013. The unemployment rate increased to 4.4 percent from 4.3 percent in May, but we also saw a small increase in the labor force participation rate.

Our forecast is for monthly job growth to slow to around 150,000 for the rest of 2017, and for the unemployment rate to decrease to 4.1 percent by the end of the year. With an economy at full employment, the Fed is likely to continue to raise short-term rates and shrink their balance sheet. Additionally, demand for housing of all types will continue to grow, and should wage growth begin to pick up, additional pressure will be exerted on house prices, especially in hard to build locations.

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org).