MBA Chart of the Week: Large Banks: Production Volume Channel Mix

Source: PGR–MBA and STRATMOR Peer Group Roundtables (% Based on $)

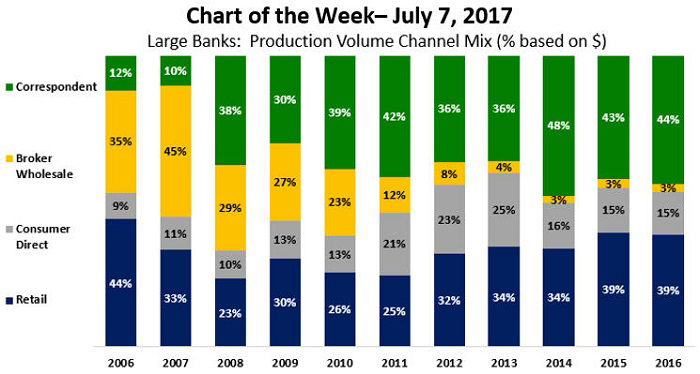

In this week’s chart, we show the share of total production volume by the four major channels–Retail, Consumer Direct, Broker/Wholesale and Correspondent–for a large bank (depository) peer group.

The peer group comprises 12-15 large banks over time, with average volume of $43 billion in 2016.

Over the 11-year period from 2006 to 2016, the Retail and Consumer Direct channels averaged nearly 45 percent of total production volume, peaking at 59 percent in 2013 when refinancings of existing customers (as well as new customers) were exceptionally strong. As for third-party originations, the Correspondent channel has represented the largest share of volume since 2010. Appetite to originate loans through the Broker/Wholesale channel has diminished over this period as banks re-positioned themselves and their risk profiles. In 2007, the Broker/Wholesale channel represented 45 percent of total originations, but it dropped to just 3 percent in 2016.

The Retail channel represents loans originated through in-house loan officers within standard mortgage office or bank branch networks. Direct face-to-face contact with the borrower is characteristic of this channel. The Consumer Direct channel includes loans typically originated through outbound or inbound telemarketing, mail and/or internet methods. Generated leads are then usually referred to a centralized call center.

The Broker/Wholesale channel represents processed loan applications that a bank purchases from a broker, and generally closed in the bank’s name. The Correspondent Channel includes closed loans that a bank purchases from correspondents. Generally, the loan is closed in the correspondent’s name as opposed to the bank’s.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org.)