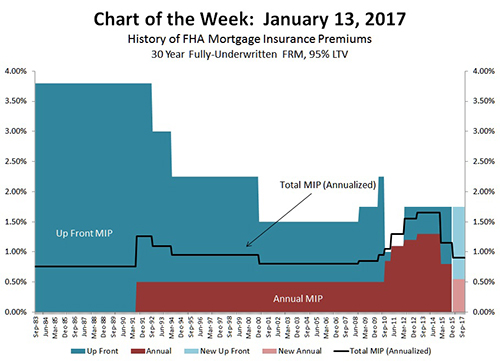

MBA Chart of the Week: History of FHA Mortgage Insurance Premiums

Source: MBA calculations using data in the Actuarial Review of the FHA MMIF Forward Loans for FY2014

In a Mortgagee Letter last week (https://portal.hud.gov/hudportal/documents/huddoc?id=17-01ml.pdf), HUD announced a reduction in its FHA annual mortgage insurance premium and an elimination of differences in MIP by loan amount.

For a fully underwritten 30-year mortgage with a 95% loan-to-value ratio, the annual MIP was reduced by 25 basis points to 55 basis points. By our estimate, this change will lower the annualized, total MIP for a 95% LTV loan to 90 basis points.

To put this in context, the total MIP has varied between 0.76% and 1.65% over the past several decades. We calculate the total mortgage insurance premium using a 5:1 ratio to convert the up-front premium and add it to the annual premium.

In his Senate confirmation hearing last week, HUD Secretary nominee Ben Carson commented that he will need to review the change with staff but stopped short of suggesting that he might reverse the decision.

The change is set to take effect on January 27.

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mortgagebankers.org.)