Regulatory Easement, Insulating Realities

(Mark Dangelo is president of MPD Organizations LLC, featuring books, industry reports and articles. He is a strategic management consultant, outsourcing advisor and analytics specialist with extensive process, technology and financial results and is a frequent contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.)

With recent business articles projecting that financial services industries will receive a windfall of up to $100 billion after the rollback of Dodd-Frank, my brain spawned an image of a banker, clean shaven, blue suit, white shirt, tired face, a Davos ticket stub in his suit pocket, and a bold, red necktie with a champagne bottle in one hand and a lending contract in the other dancing to the lyrics of, “… we’re going to party like its 1999 …”.

After banks spent tens of billions fighting, settling and influencing multi-agency legislation, the new U.S. administration has signaled its intent for a multi-year effort to “tame” what is portrayed as numerous unfriendly, government overreaches. Simpler would be nice, but billions have already been spent in preparation.

This market controlling regulatory beast, a seven-headed hydra for this discussion–one head Dodd-Frank; the second, the Consumer Financial Protection Bureau; the third, stress-tests and living wills; the fourth, Basel III; the fifth, attributable risk and cybersecurity; the sixth, domestic oversight and governance; and the seventh, everything else–has increased compliance costs between 300-700 percent for every bank budget since the start of Great Recession a decade ago.

Layer on internal and external auditing diligence and legal disclosures (and adherence and reporting and data) and costs rise even further, in the wake of a dearth of talent and skills needed for updating and maintenance. We settled on “boiling the oceans”–not providing the isolation or risk compartmentalization that drove initial intents for a “safe and sound” financial system.

Indeed, from most common sense approaches, regulatory moderation is something that needs to happen sooner than later to reduce burden while promoting comprehension, eliminating duplication and enabling global competitiveness.

However, for bankers and an administration that states lending is curtailed for, “…so many people, friends of mine, that have nice businesses and they can’t borrow money” may not reflect the reality of market actions. For in this instance, as noted in Bloomberg, these statements may test reality especially when commercial lending has risen by more than $2 trillion in just four years–double the eight prior years. So, what else do we factually know about the actions within our regulated environment against what is stated or perceived?

As we know, interest rates have been held historically low by the Federal Reserve and are still below adjusted measures before the housing meltdown. As we know, housing supply is also at a multi-decade low (estimated to be under four months). As we know, homeownership is bouncing around 63 percent (the lowest per the U.S. Census since 1965) and off the heights of 69 percent back in 2004-2006. And as we know, the Federal Reserve may start to unwind (i.e., stopping reinvestments) the $1.75 trillion in mortgage-backed securities with a downstream consequence of raising interest rates, while reducing GSE purchases–and perhaps hastening the latter’s repurposing. Finally, we know that with farming income at $63 billion, half of what it was just four years ago, a likely outcome may be a substantial increase of land availability for household formations and homebuilding. Even farmers, of which I am one, need to eat and pay bills (this group represents the next, biggest set of bankruptcies forthcoming).

It seems, that if regulations are going to be relaxed for the stimulation of homeownership and supported by responsible borrowing, then conditions must be set to provide a resurgence of private market and capital opportunities where risks are recognized and priced accordingly.

After all, with the baby boomers declining and millennials sidelined by an anemic recovery over the past decade, there is opportunity for the 75 million millennials to take a larger economic responsibility, including home loans, which are currently being written at a rate of two to one for women over men. What is seldom debated, post-recessionary regulations, is that the transparency of what the banking industry is producing is far greater than just five years ago. Therefore, elimination any regulatory compliance burden will be weighed against financial product transparency, safe and soundness–even before attributes of consumer protection and de-risking are absorbed.

So, this is where the industry finds itself. At the beginning of an anticipated, prolonged easement cycle that may be timed with a generational demand for rapid products (i.e., private securitizations) driven by pressures that may push originations well past the $1.5 trillion per year (not including refinancing). Broken down further, if refinancing holds at the 10-year norm of 40-50 percent of all loans generated–compared to Q4 2008-Q2 2013 where refinancing was 50-70 percent of the total (per ATTOM Data Solutions)–a prolonged lending cycle under a regulatory easement may significantly enlarge opportunities for lenders seeking an expanded base of clientele. It seems nothing could be wrong and that regulatory easement may have found “legs” in the face of need.

Yet, as the new administration is finding out, just because they sign an order, doesn’t mean that it will be immediately followed or implemented. It took decades to craft the rule sets today–many of which were designed for a finance world that doesn’t exist domestically or globally when it comes to consumer behaviors, money flows, data availability, research and reporting and well nearly the entire financial supply chain (e.g., virtual and digital currencies, cloud computing, 24/7 market trading, KYC solutions, credit risk management and mitigation).

It essence, by the time a rule is written, it is usually for a commoditized market offering–not innovation and consumer advances. One could argue that regulations as conceived today is folly when applied to the technology and data capabilities in existence.

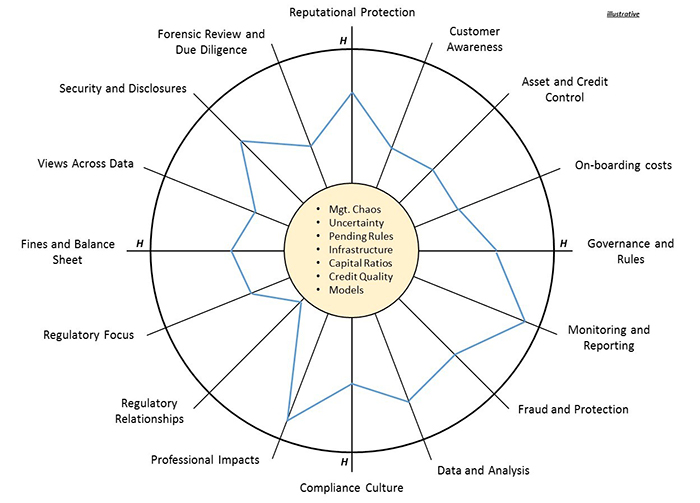

To solidify the aforementioned statements and trends, regulatory easement (and compliance), should be viewed as part of a mosaic of factors as shown in the diagram following. When mapped out against these illustrative characteristics, a coverage area can be discernible for impact, deficiencies and investment. This approach, when applied with objective assessments, can demonstrate before and after projections thereby properly gauging impacts against existing operations and proposed initiatives.

Additionally, HBR noted that 98 percent of enterprises are modifying their business models because of rapid changes in global and political landscapes.

In general, the promise of regulatory easement begs a few additional questions when reviewed against the above:

–What will easement do to risks, compliance activities and personnel mixes?

–If easement or rollbacks are achieved, how will the organizational transformation initiated by this hydra be impacted?

–What downstream consequences occur if consumer-facing rules are rewritten (e.g., if lending is spurred, what does this do for balance sheets, private securities, new instrument classes)?

–How will these reductions of regulatory compliance impact sizes of institutions (e.g., community banks versus systemically critical)?

–Will insights driven from complex data collection lead to less operational improvements, actionable intelligence and risk attribution? If we remove what we had been directed to complete, are we blinding ourselves?

These are just some questions that surface at the mere mention of easements or repeals.

My personal belief is that because very few individuals were held directly responsible for the demise of stoic firms and individual families, rules written since 2009 were about extracting “a pound of flesh.” However, these retribution principles morphed into something else, becoming vehicles for channeling of anger against those deemed elite or “untouchable.”

Easement of regulations brings a unintended whale-tail risk that could have huge economic and political risks–which is why easement and not direct repeal will be the likely norm. And even with fast intent, delayering of complex processes, technology, people and data will take months and months as most institutions already have made huge investments.

We are experiencing a great deal of uncertainty across our society and within our various industry sub-segments. We still have bad actors doing nasty actions to unsuspecting consumers and investors. As a collective industry, we have sought to drive out asymmetrical information spurred on by a heavy hand of the regulators. Our operations are now some of the most advanced in the world, due to a need to automate for cost efficiencies–and spurred by regulatory compliance.

Yes, regulatory easement is needed. Yes, we need to apply common sense to our financial supply chains. And yes, easement provides a huge windfall of avoiding in solutions that simply comply with a regulation.

But no, easement cannot represent the elite of Davos regenerated. Easement brings an opportunity for the industry to quit looking down–or in some cases over our shoulder. We cannot drive forward looking into our rearview mirror. We cannot pretend the old days have once again come and party like the privileged–no matter what that tweet said.

(Views expressed in this article do not necessarily reflect the views or policies of the Mortgage Bankers Association. MBA NewsLink welcomes your contributions; articles or inquiries should be submitted to Mike Sorohan, editor, at msorohan@mortgagebankers.org.)