MBA Chart of the Week: CPI and Selected Components

Source: Bureau of Labor Statistics

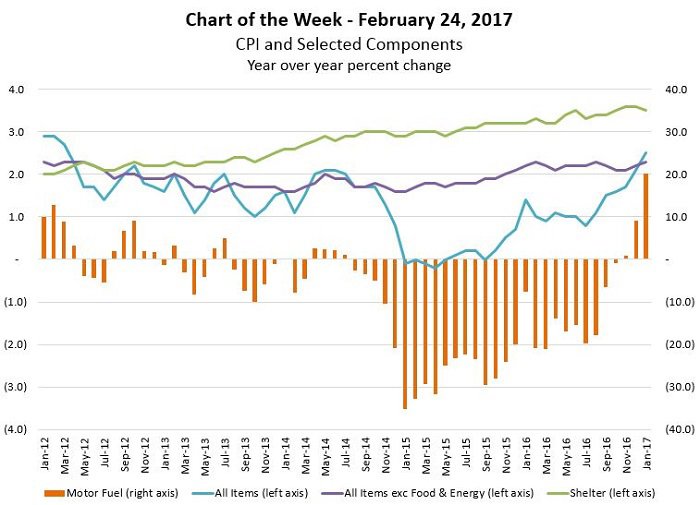

Overall Consumer Price Index growth in January grew at a pace of 2.5 percent on a year over year basis, the fastest pace since 2012, eclipsing core inflation–which excludes food and energy–for the first time since 2014.

Notably, energy prices, represented here by the year over year change in motor fuel prices, are contributing upward pressure on overall inflation after a sustained period of price declines.

Shelter prices, which are dominated heavily by rental costs, increased 3.5 percent in January compared to the year before. Sustained increases in rental costs have burdened renters since 2007 and are often blamed for preventing future homeowners from being able to save for a down payment on a home.

The January inflation results are particularly significant because of speculation about when the Federal Reserve might next raise rates. The Fed’s preferred measure of inflation, the personal consumption expenditure price index, grew by a 1.6 percent in December, and the January reading for this metric is set to be released next week.

A rapid rise in inflation provides more impetus for a rate hike, especially since the job market has been strong for some time now. While MBA continues to call the next rate increase for June, the probability of a March increase has been recently increasing.

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org).