MBA Chart of the Week: FHA Average Credit Scores on New Endorsements

Source: HUD

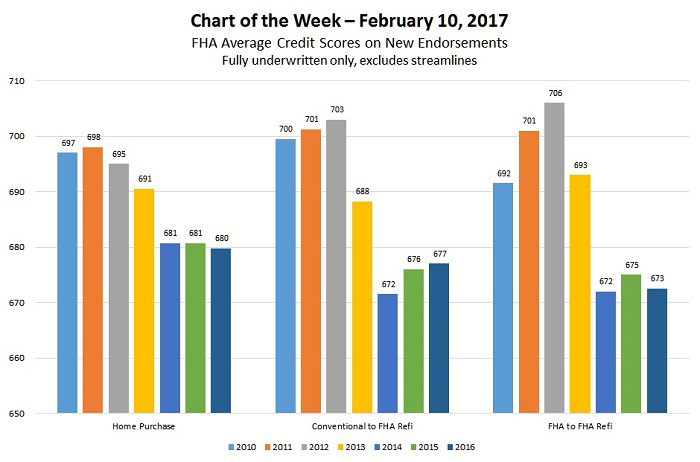

While the average credit score on new FHA endorsements has fallen as the agency has withdrawn from its counter-cyclical role during the crisis, changes have been uneven across products and loan purposes.

This week’s chart depicts the average credit scores on new FHA mortgage endorsements between 2010 and 2016. There is a clear drop in the average credit scores for all products following policy changes in 2012 and 2013 that increased the effective mortgage insurance premium. At the height of the refi boom in 2012, average credit scores were higher for refinances than for purchase endorsements, while average purchase credit scores have recently been a bit higher than refinances.

With the subsequent reduction in the annual MIP rate introduced in January 2015, there was a tripling in FHA refinance activity over the short term and a more persistent upward shift in FHA purchase endorsements over the longer term. The MIP reduction also had the impact of stabilizing the credit profile of the FHA book by drawing stronger credit borrowers to FHA via conventional to FHA refinances.

This also suggests that conventional borrowers are more sensitive to the relative change in costs resulting from FHA policy changes compared to existing or prospective FHA borrowers. On the home purchase side, the typical credit score for home purchases following the MIP decrease did not change compared to 2014.

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mortgagebankers.org.)