Technology, Folly in an Age of Commoditization?

(Mark Dangelo is president of MPD Organizations LLC, featuring books, industry reports and articles. He is a strategic management consultant, outsourcing advisor and analytics specialist with extensive process, technology and financial results and is a frequent contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.)

With the chaos and frequency of change spread across the headlines, it will continue to be difficult for financial services leaders to focus on enduring or important aspects of their business models.

These distractions, or some might use as “wins,” will take precious energy away from an emerging innovation curve, while giving legitimacy to fight for a legacy of commoditization that has taken hold across industries and especially within financial services.

The desire, and in some cases a need, for immediate reaction to industry or government directives will create knee-jerk initiatives that will range from zero-based budgeting to visa availability to anti-corruption reporting to tax consequences to the most sought after, a reduction or non-enforcement of regulations. Some of the directives will work, some will be unwelcome distractions–a few will require substantial changes to business models or market offerings.

Much will transpire in 2017, but the lasting impacts or the reality of the directives will be hammered out in committees, by agencies and in the courts not just domestically, but globally. However, what has become even more urgent across boardrooms and within vertical financial services departments is an urgency to automate–while offering American jobs for American workers.

Technology solutions, as a ubiquitous catchall phrase, will be more than ever stacked, compartmentalized, shared, developed, leveraged and “borrowed” in a quest to stay relevant to consumers and regulators. Enterprises will seek “innovative relevance” from Fintech providers, social firms, data aggregators and others all at the mandate of achieving a competitive or efficiency advantage.

Yet, across the discussions, directives and offerings, there is still little in understanding (or agreement) as to the rationale of why things are to the state they are at. What is surprising, is that those who are greatly benefiting from the decades of shifts believe the global markets are required to support their continued actions (e.g., China).

Across recorded history, when jobs and functions shift, what usually has transpired is a result of commoditization of product, functionality or expertise, and not as many wish to believe merely a transference of income inequality to emerging nations (see “China’s Xi Jinping Seizes Role as Leader on Globalization,” Wall Street Journal, January 17, 2017). Shifts to gain arbitrage start with early cycle commoditization–labor arbitrage in a world increasingly dominated by services makes the decision even more compelling.

A basic failure to reinvent or to innovate creates at its core a business motive to focus on fixed costs and variable expenses (when dealing with commoditization). Like any innovation or highly complex process, they will be dissected and sliced to appeal to mass markets thereby broadening the appeal and driving down costs. These tenants were precisely why outsourcing and globalization especially among services took place since the mid-1990s resulting in a set of industry SIC codes generating annually in excess of $80 billion.

Therefore, in an age of transformation and commoditization across industries, which if we step back from the chaos and look at the fundamental drivers–from telecommunications to retail to sourcing to financial services to a wide range of professional services–what is striking is the lack of acceptance by those providing value to the end customer that shoring as part of commoditization is a natural progression especially when little is invested in the reeducation of workforces (or towards non-incremental innovation).

It is worth noting that the U.S. is at the bottom per the OECD in percentage of GDP spent for worker, retraining at 0.29% compared with Germany for instance who spends 1.59% and Spain which spends 3.37%. Factor in $1.5 trillion in educational debt (growing by nearly $3,000 every second) and we can start to understand why a declining set of middle class workers feel overburdened–lessening their purchasing power on traditional asset-based economic staples such as homeownership.

Alarming is that enterprises have constructed their own truisms that if regulations are removed and protections put in place, customers and profits will return even though much of what they continue to offer as core products and services have been commoditized. This misplaced optimism may be the result of a failure to comprehend that commoditization takes place on many granular levels and is spread across facets that are beyond singular app, vertical consumer products or technology decisions.

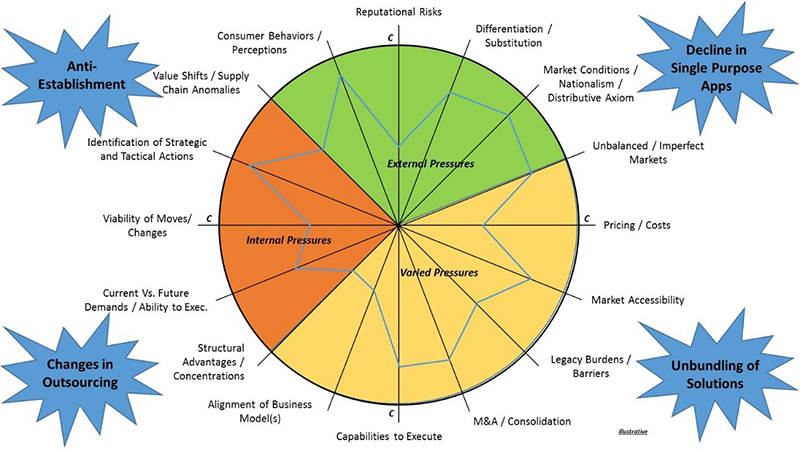

Verticalization of technology was once the preferred approach of solution set selection and implementation. As shown in the diagram below, without a broader perspective, technological follies can be easily deployed for short-term results, but long term, may result in a cascading series of failures.

Just as singular purpose apps are dying, financial service providers are failing to comprehend and prepare for the eventuality that with disintermediation of products and services directly to consumers comes the next act of the show–commoditization of their most coveted revenue generation components.

Aided by rapidly evolving consumer behaviors and technological advancements, enterprises both iconic and nascent are structurally and fiscally struggling to adapt offerings at a pace once thought impossible. Within financial services, business leaders are being forced to reinvent their operating models at a fast-tracked rate in the past 18 months spurred by anti-establishment populism and de-globalization forces (not to mention Amazon, Alphabet and others).

Moreover, as consumption habits transform, unbundling will be the norm as data is encapsulated and compartmentalized to spur rapid assembly of new solutions. Outsourcing benefits will likely shrink until 2019 as their business models will require catastrophic revisions–visas availability, sentiments, taxes, cross-border recriminations and more. What will emerge are innovative services that will further commoditize financial services’ core offerings in favor or P2P, AI, and social cohesions (and these are just the tip).

Financial services firms, like people, should avoid the trap of a prescription for every ailment. As noted in the diagram above, commoditization occurs because of numerous interrelated characteristics each with a direct impact on potential solutions–technology included. If we adhere to the solution axioms of an app for every problem, we will end up with solutions having negative interactions with others thus squandering limited resources and market timings.

For the first half of 2017, entrenched bankers have an opportunity and a liability. As chaos management practices consume media cycles, there is an opportunity to invest in new cycles while protected from external forces (indeed, dust off chaos management principles and they closely align with emerging government directives). Yet, risks of not addressing internal and varied pressures from the diagram above, will likely create losses and failures when the window of opportunity closes.

When the window closes, the evidence of financial services industry commoditization will be crystal clear. Perhaps the random and seemingly unprecedented chaos of recent directives really is there for a greater purpose? Perhaps this chaos serves the industry very well if it is used to plan a new cycle of non-incremental innovation? Perhaps it is a runway for comprehensive reengineering and restructuring? Perhaps it might be nothing more, if taken merely at their face value, a path to lead us into technology folly?

Rearranging of the deck chairs really doesn’t seem to be an option when factoring in the cross-connected financial markets tightly linked to domestic outcomes. If financial services industries within the U.S. is to retain its leadership roles, don’t look to the speeches from Davos–start deciphering the chaos management coming from the emerging government orders. These shifts will greatly accelerate commoditization–not halt it.

Finally, and closer to home, if the government-sponsored enterprises are finally transformed, private mortgage-backed securities again take a larger portion of the market, and taxes and barriers are applied to products and services, are we at the start of a new innovation curve for housing? Or are we lacking the ability to take, as established institutions, a leadership role with the burden of legacy/commoditization of offerings?

I will close with a statistic from an ABA infographic on Millennials and Banking. If financial institutions are so valued and offer unique solutions, why is it that 71% “would rather go to the dentist than listen to what banks are saying?”

(Views expressed in this article do not necessarily reflect the views or policies of the Mortgage Bankers Association. MBA NewsLink welcomes your contributions; articles or inquiries should be submitted to Mike Sorohan, editor, at msorohan@mortgagebankers.org.)