CRE Alternative Lending Increasing

Alternative lenders are on the rise in commercial real estate finance–and a recent upswing in alternative lending appears to be compensating for a similar decline in bank lending, reported CrediFi, New York.

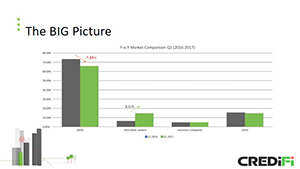

CrediFi examined $178 billion in commercial real estate loans originated in New York, Chicago and Boston from first-quarter 2016 to first-quarter 2017. It found that financing originated by banks dropped nearly 8 percent in that period.

CrediFi examined $178 billion in commercial real estate loans originated in New York, Chicago and Boston from first-quarter 2016 to first-quarter 2017. It found that financing originated by banks dropped nearly 8 percent in that period.

“Bank origination in the first quarter of this year fell to less than 70 percent of commercial real estate financing dollars in the three markets analyzed in our sample,” the report said. “During the same period, commercial real estate financing by alternative lenders increased more than 8 percent in those markets.”

CrediFi said “alternative lenders” refers to non-bank lenders such as hedge funds, private equity funds, real estate investment trusts, debt funds and pension companies in this analysis. Insurance companies were analyzed separately and are not included in the alternative lender category.

“Commercial real estate lending by insurance providers in our sample remained stable,” Credifi said. It noted non-bank lenders that don’t fit into the above categories, including government lenders, credit unions and private individuals, were classified as other.

Despite growing originations from alternative lenders, CrediFi noted that banks continue to provide most commercial real estate financing. Just under three-quarters of the $178 billion in commercial real estate financing sampled came from banks for properties in New York City, Chicago and Boston over the five quarters analyzed.

“Though banks continue to be a huge force in the commercial real estate finance market, they–as well as the rest of the industry–would be wise to pay attention to the increasingly significant role alternative lenders are playing,” the report said.