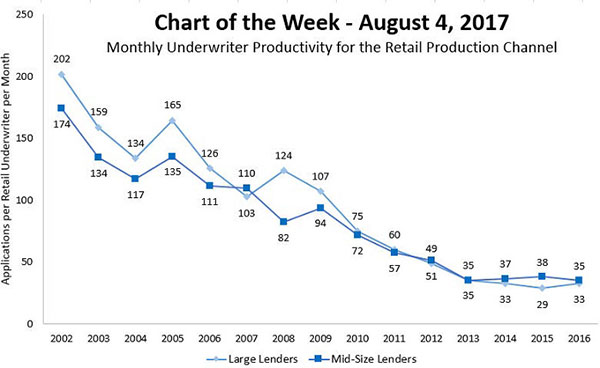

MBA Chart of the Week: Monthly Underwriter Productivity for Retail Production Channel

Source: PGR–MBA and STRATMOR Peer Group Roundtables

Average monthly underwriter productivity for the retail production channel (excluding third party and consumer direct originations) fell for more than a decade before flattening out over the past four years across lender types, whether large or mid-size.

For large lenders (firms originating +/- $15 billion in retail originations on average in 2016), productivity averaged 33 applications per underwriter per month in 2016, up from 29 applications per month in 2015. For mid-size lenders (firms originating +/- $2 billion in retail originations on average in 2016), productivity dropped to 35 applications per underwriter per month. Nonetheless, mid-size lenders have outperformed large lenders over the past three years.

Among the many factors influencing underwriter productivity are product type; geography of loans being underwritten; accessibility, accuracy and completeness of required documentation; availability of support from other staff such as processors and loan officer assistants; and perceived representations and warranties and other compliance risks that may slow decision-making. As technology solutions are introduced to improve speed and accessibility to required verifications and documentation, the potential for improvement exists.

Monthly productivity is measured as the average of the number of mortgage applications in a given year divided by the number of full‐time equivalent underwriters, divided by twelve. Underwriters include junior, senior and all other level underwriters as well as appraisal reviewers, validators and credit analysts.

(Marina Walsh is vice president of industry benchmarking and research with MBA; she can be reached at mwalsh@mba.org.)