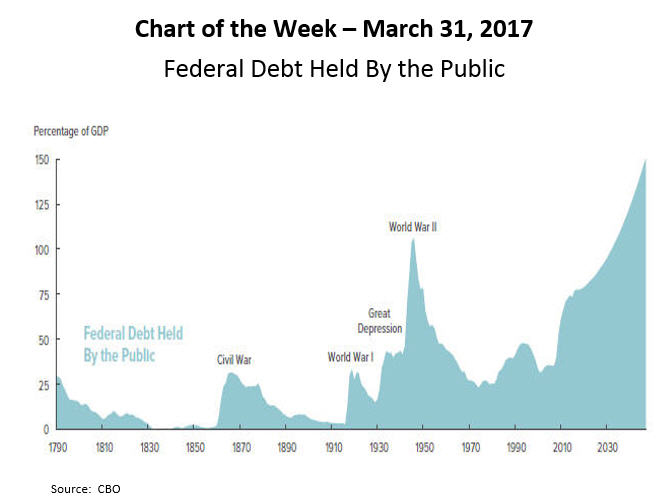

MBA Chart of the Week: Federal Debt Held By the Public

Source: Congressional Budget Office

As of January, U.S. federal debt held by the public stood equal to 77 percent of gross domestic product, the highest level since World War II.

The Congressional Budget Office’s long-term projections (here) show the federal debt rising to 150 percent of GDP over the next 30 years as spending growth continues to outpace revenue growth.

A growing federal debt can impact the economy in multiple ways, both directly and indirectly. A direct impact will be that the amount of interest owed will continue to increase and at an increasing rate because of rising interest rates. As interest owed on the debt becomes a larger part of the federal budget, it will tend to crowd out other spending. It will also tend to crowd out private investment since the federal debt will claim so many resources, further raising interest rates and slowing economic growth.

As the CBO notes, the rising debt could also impair the government’s ability to respond to a crisis and could increase the likelihood of a fiscal crisis in which investors begin to doubt the ability of the U.S. to repay its debt.

Most importantly for the mortgage market, this is another factor likely to put upward pressure on mortgage rates over the medium term.

(Michael Fratantoni is chief economist and senior vice president of research and economics with the Mortgage Bankers Association. He can be reached at mfratantoni@mba.org. Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mba.org.)