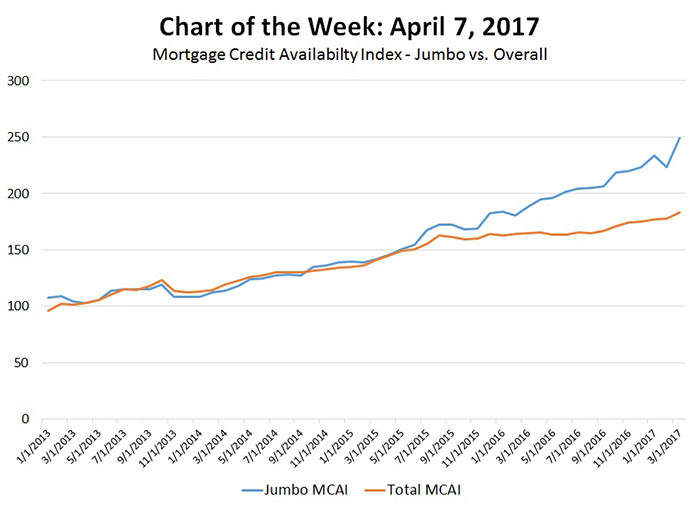

MBA Chart of the Week: Mortgage Credit Availability Index–Jumbo v. Overall

Source: MBA Mortgage Credit Availability Index Powered by Ellie Mae’s AllRegs Market Clarity

Credit availability for jumbo loans has been on an upward trend since 2014. In March, the Jumbo MCAI registered its largest one-month increase since MBA began tracking the series.

The 11.7 percent increase in March more than reversed a 4.4 percent decline observed in February, which represented the first decline in the Jumbo MCAI in nearly a year. The increase in March was driven by a wave of new adjustable-rate jumbo offerings.

Jumbo loans are defined as mortgage with amounts above the conforming loan limit at any given point in time. The maximum conforming loan amount can be higher in high costs areas, but MBA classifies such “super-conforming” mortgages above the national conforming limit as jumbo loans.

The increased supply of jumbo loans aligns with results from the MBA Weekly Applications Survey. Applications data have shown stronger growth in loan applications for higher balance loans compared to lower loan balances, and the average loan size for home purchase mortgages hit a survey high last week.

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit.

For more on the MCAI, click https://www.mba.org/news-research-and-resources/research-and-economics/single-family-research/mortgage-credit-availability-index.

(Lynn Fisher is vice president of research and economics with MBA; she can be reached at lfisher@mba.org. Joel Kan associate vice president of economic forecasting with MBA; he can be reached at jkan@mortgagebankers.org. Brennan Zubrick is senior financial reporting and data management analyst with MBA; he can be reached at bzubrick@mba.org.)